"Wesley Snipes sick" refers to Wesley Snipes' 2006 hospitalization due to tax issues and his subsequent conviction for failure to file income tax returns.

Snipes was sentenced to three years in prison in 2008 and was released in 2013. The case was highly publicized and raised awareness of tax fraud and the consequences of failing to file tax returns.

The term "Wesley Snipes sick" is often used to refer to the broader issue of tax fraud and the need for individuals to comply with tax laws.

- Unveiling The Secrets Discoveries And Insights Into Peso Pluma Siblings

- Unraveling The Truth Jimmy Kimmels Departure From Latenight

- Unveil The Enigmatic Grace Jones Discoveries And Untold Insights

- Is Caribe Devine Married Uncover The Truths And Insights

- Unleashing The Secrets Of Johvonnie Jackson A Journey Of Excellence

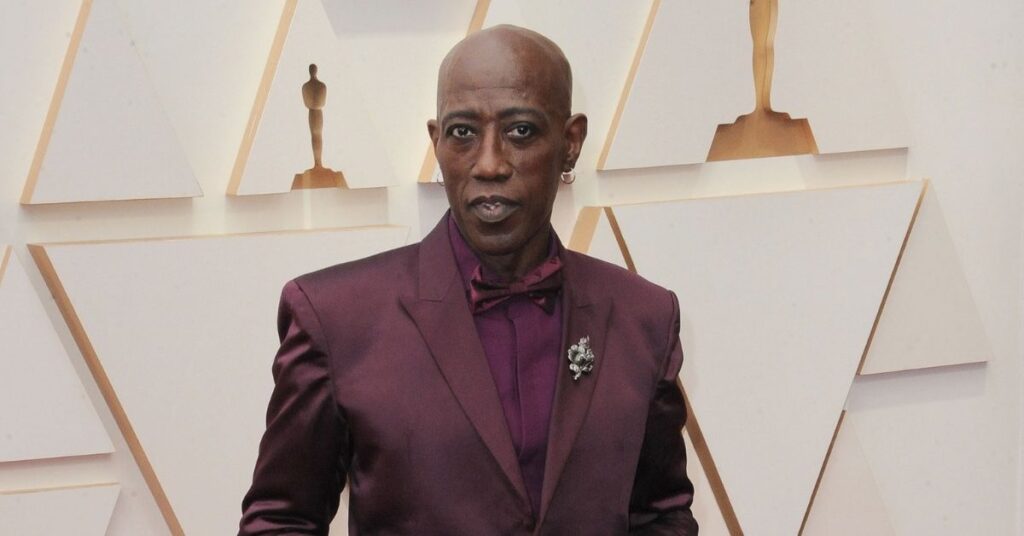

Wesley Snipes sick

The term "Wesley Snipes sick" refers to Wesley Snipes' 2006 hospitalization due to tax issues and his subsequent conviction for failure to file income tax returns. The case raised awareness of tax fraud and the consequences of failing to file tax returns.

- Tax fraud: Snipes was convicted of failing to file income tax returns for several years.

- Tax evasion: Snipes used various schemes to avoid paying taxes, including filing false tax returns and hiding assets.

- Celebrity status: Snipes' case was highly publicized due to his celebrity status.

- Public awareness: The case raised public awareness of tax fraud and the need for individuals to comply with tax laws.

- Prison sentence: Snipes was sentenced to three years in prison for tax fraud.

- Financial consequences: Snipes was ordered to pay millions of dollars in back taxes and penalties.

- Legal precedent: The case set a legal precedent for the prosecution of tax fraud cases.

- Deterrence: The case served as a deterrent to others considering committing tax fraud.

The case of "Wesley Snipes sick" is a cautionary tale about the consequences of tax fraud. It is important for individuals to comply with tax laws and to seek professional advice if they have any questions about their tax obligations.

Tax fraud

Wesley Snipes' conviction for tax fraud is a significant aspect of the "Wesley Snipes sick" case. Tax fraud refers to the intentional failure to comply with tax laws, including the willful attempt to evade or defeat a tax.

- Unveiling The Secrets Of Lauren Godwins Height Discoveries And Insights

- Unveiling The Age Of Amity From The Owl House A Journey Of Growth And Discovery

- Unveiling The Cinematic Journey Of Diane Farr Discoveries And Insights

- Unveiling The Heartwarming World Of Ellen Pompeos Family A Journey Of Love And Resilience

- Unveiling The Inspiring Story Of Kristen Bells Mother

- Underreporting income: Snipes failed to report all of his income on his tax returns, which resulted in him paying less tax than he owed.

- Filing false returns: Snipes filed false tax returns that contained incorrect information about his income and deductions.

- Hiding assets: Snipes used various schemes to hide his assets from the IRS, including transferring assets to offshore accounts.

- Using nominees: Snipes used nominees to hold title to assets and to conduct financial transactions in an attempt to conceal his involvement.

Snipes' conviction for tax fraud is a reminder that tax fraud is a serious crime with severe consequences. Individuals who are convicted of tax fraud may face significant fines, imprisonment, and reputational damage.

Tax evasion

Tax evasion is a serious crime that can result in significant penalties, including fines and imprisonment. Wesley Snipes' conviction for tax evasion is a reminder of the importance of complying with tax laws and the consequences of failing to do so.

- Underreporting income: Snipes failed to report all of his income on his tax returns, which resulted in him paying less tax than he owed. This is a common form of tax evasion, and it can be difficult to detect.

- Filing false returns: Snipes filed false tax returns that contained incorrect information about his income and deductions. This is a more serious form of tax evasion, and it can result in more severe penalties.

- Hiding assets: Snipes used various schemes to hide his assets from the IRS, including transferring assets to offshore accounts. This is a complex form of tax evasion, and it can be difficult to prove.

- Using nominees: Snipes used nominees to hold title to assets and to conduct financial transactions in an attempt to conceal his involvement. This is a sophisticated form of tax evasion, and it can be difficult to detect.

The case of "Wesley Snipes sick" is a cautionary tale about the consequences of tax evasion. It is important for individuals to comply with tax laws and to seek professional advice if they have any questions about their tax obligations.

Celebrity status

The celebrity status of Wesley Snipes played a significant role in the "Wesley Snipes sick" case. The high-profile nature of the case attracted significant media attention and public scrutiny.

The media coverage of the case raised public awareness of tax fraud and the consequences of failing to file tax returns. The case also served as a cautionary tale for other celebrities and high-profile individuals who may be tempted to engage in tax fraud.

The celebrity status of Wesley Snipes also made it more difficult for him to hide his assets and evade taxes. The IRS was able to use its resources to track down Snipes' assets and to hold him accountable for his tax fraud.

The case of "Wesley Snipes sick" is a reminder that no one is above the law, not even celebrities. It is important for everyone to comply with tax laws and to seek professional advice if they have any questions about their tax obligations.

Public awareness

The "Wesley Snipes sick" case played a significant role in raising public awareness of tax fraud and the need for individuals to comply with tax laws. The high-profile nature of the case attracted significant media attention and public scrutiny, which helped to educate the public about the consequences of tax fraud.

- Increased media coverage: The "Wesley Snipes sick" case was widely reported in the media, which helped to raise public awareness of tax fraud. The media coverage also highlighted the importance of complying with tax laws and the consequences of failing to do so.

- Public outrage: The public was outraged by the fact that Wesley Snipes, a wealthy celebrity, had failed to pay his taxes. This public outrage helped to put pressure on the IRS to investigate Snipes and to hold him accountable for his actions.

- Celebrity influence: The celebrity status of Wesley Snipes made the case even more newsworthy and helped to raise public awareness of tax fraud. The case served as a cautionary tale for other celebrities and high-profile individuals who may be tempted to engage in tax fraud.

The "Wesley Snipes sick" case is a reminder that everyone is responsible for paying their taxes. It is important for individuals to comply with tax laws and to seek professional advice if they have any questions about their tax obligations.

Prison sentence

The prison sentence that Wesley Snipes received for tax fraud is a significant aspect of the "Wesley Snipes sick" case. Snipes' conviction and subsequent imprisonment served as a stark reminder of the consequences of failing to comply with tax laws.

- Deterrence: Snipes' prison sentence served as a deterrent to others who may be tempted to engage in tax fraud. The case showed that even wealthy and famous individuals are not above the law and that tax fraud will be punished severely.

- Public accountability: Snipes' imprisonment demonstrated that the public holds celebrities and other high-profile individuals to a high standard of accountability. The case sent a message that no one is above the law and that everyone is responsible for paying their taxes.

- Public awareness: Snipes' prison sentence helped to raise public awareness of tax fraud and the consequences of failing to file tax returns. The case served as a cautionary tale for taxpayers and reminded them of the importance of complying with tax laws.

The "Wesley Snipes sick" case is a reminder that everyone is responsible for paying their taxes. It is important for individuals to comply with tax laws and to seek professional advice if they have any questions about their tax obligations.

Financial consequences

The financial consequences of Wesley Snipes' tax fraud conviction were significant. He was ordered to pay millions of dollars in back taxes and penalties, which put a major strain on his finances.

The financial consequences of Snipes' conviction served as a deterrent to others who may be tempted to engage in tax fraud. The case showed that even wealthy and famous individuals are not above the law and that tax fraud will be punished severely.

The financial consequences of Snipes' conviction also highlighted the importance of complying with tax laws. The case served as a reminder that everyone is responsible for paying their taxes and that failing to do so can have serious financial consequences.

Legal precedent

The "Wesley Snipes sick" case set a significant legal precedent for the prosecution of tax fraud cases. The case established several important principles that have been used in subsequent tax fraud prosecutions.

- The government does not need to prove that a defendant intended to evade taxes in order to convict them of tax fraud. Prior to the Snipes case, the government had to prove that a defendant intended to evade taxes in order to convict them of tax fraud. However, the Snipes case established that the government only needs to prove that a defendant knowingly and willfully failed to file a tax return or pay taxes.

- The government can use circumstantial evidence to prove tax fraud. In the Snipes case, the government used circumstantial evidence, such as Snipes' failure to file tax returns and his use of nominees, to prove that he had committed tax fraud. This case established that the government can use circumstantial evidence to prove tax fraud, even if it does not have direct evidence that a defendant intended to evade taxes.

- Celebrities and other high-profile individuals are not immune from prosecution for tax fraud. The Snipes case sent a clear message that celebrities and other high-profile individuals are not immune from prosecution for tax fraud. The case showed that the government is willing to prosecute tax fraud cases, regardless of the defendant's fame or wealth.

The "Wesley Snipes sick" case has had a significant impact on the prosecution of tax fraud cases. The case established several important legal precedents that have been used in subsequent tax fraud prosecutions. The case also sent a clear message that celebrities and other high-profile individuals are not immune from prosecution for tax fraud.

Deterrence

The "Wesley Snipes sick" case served as a significant deterrent to others considering committing tax fraud. The case highlighted the serious consequences of tax fraud and demonstrated that even wealthy and famous individuals are not above the law.

- Increased public awareness: The "Wesley Snipes sick" case raised public awareness of tax fraud and the consequences of failing to file tax returns. The media coverage of the case educated the public about the importance of complying with tax laws and the penalties for tax fraud.

- Celebrity influence: The celebrity status of Wesley Snipes made the case even more newsworthy and helped to raise public awareness of tax fraud. The case served as a cautionary tale for other celebrities and high-profile individuals who may be tempted to engage in tax fraud.

- Legal precedent: The "Wesley Snipes sick" case set a legal precedent for the prosecution of tax fraud cases. The case established several important principles that have been used in subsequent tax fraud prosecutions, including the principle that the government does not need to prove that a defendant intended to evade taxes in order to convict them of tax fraud.

- Increased enforcement: The "Wesley Snipes sick" case led to increased enforcement of tax laws. The IRS has since devoted more resources to investigating and prosecuting tax fraud cases, which has resulted in an increase in the number of tax fraud convictions.

The "Wesley Snipes sick" case is a reminder that tax fraud is a serious crime with severe consequences. The case served as a deterrent to others considering committing tax fraud and helped to raise public awareness of the importance of complying with tax laws.

FAQs about "Wesley Snipes sick"

The "Wesley Snipes sick" case raised a number of questions about tax fraud and the consequences of failing to file tax returns. Here are some frequently asked questions about the case:

Question 1: What is tax fraud?Tax fraud is the intentional failure to comply with tax laws, including the willful attempt to evade or defeat a tax.

Question 2: What are the consequences of tax fraud?The consequences of tax fraud can include significant fines, imprisonment, and reputational damage.

Question 3: Why was Wesley Snipes convicted of tax fraud?Wesley Snipes was convicted of tax fraud for failing to file income tax returns for several years.

Question 4: What was Wesley Snipes' sentence for tax fraud?Wesley Snipes was sentenced to three years in prison for tax fraud.

Question 5: Did Wesley Snipes pay the taxes that he owed?Yes, Wesley Snipes paid the taxes that he owed, plus interest and penalties.

Question 6: What is the significance of the "Wesley Snipes sick" case?The "Wesley Snipes sick" case is a cautionary tale about the consequences of tax fraud. The case also raised public awareness of tax fraud and the importance of complying with tax laws.

It is important to note that tax fraud is a serious crime with severe consequences. Individuals who are convicted of tax fraud may face significant fines, imprisonment, and reputational damage.

If you have any questions about your tax obligations, it is important to seek professional advice from a qualified tax advisor.

Tips to Avoid Tax Fraud

Tax fraud is a serious crime with severe consequences. The "Wesley Snipes sick" case is a cautionary tale about the importance of complying with tax laws and the consequences of failing to do so.

Here are five tips to help you avoid tax fraud:

Tip 1: File your tax returns on time and accurately.The most important thing you can do to avoid tax fraud is to file your tax returns on time and accurately. This means reporting all of your income and deductions, and paying the taxes that you owe.Tip 2: Keep good records.

Keep good records of your income and expenses throughout the year. This will make it easier to prepare your tax returns and will help you to avoid making mistakes.Tip 3: Seek professional advice if you have any questions.

If you have any questions about your tax obligations, it is important to seek professional advice from a qualified tax advisor. A tax advisor can help you to understand the tax laws and to make sure that you are complying with them.Tip 4: Be aware of the consequences of tax fraud.

Tax fraud is a serious crime with severe consequences. Individuals who are convicted of tax fraud may face significant fines, imprisonment, and reputational damage.Tip 5: Report suspected tax fraud.

If you suspect that someone is committing tax fraud, you can report it to the IRS. The IRS has a toll-free hotline that you can call to report suspected tax fraud.

By following these tips, you can help to avoid tax fraud and protect yourself from the serious consequences that can result from it.

If you have any questions about tax fraud, you can visit the IRS website or contact the IRS at 1-800-829-1040.

Conclusion

The "Wesley Snipes sick" case is a cautionary tale about the consequences of tax fraud. Snipes was convicted of failing to file income tax returns for several years and was sentenced to three years in prison. The case raised public awareness of tax fraud and the importance of complying with tax laws.

Tax fraud is a serious crime with severe consequences. Individuals who are convicted of tax fraud may face significant fines, imprisonment, and reputational damage. It is important to file your tax returns on time and accurately, keep good records, and seek professional advice if you have any questions about your tax obligations.

Related Resources:

Detail Author:

- Name : Duncan Harris V

- Username : amcdermott

- Email : johns.devonte@bechtelar.com

- Birthdate : 1985-06-05

- Address : 5942 Nolan Locks Suite 822 Willmsview, NE 52377-7186

- Phone : 470-874-0652

- Company : Stamm, Bednar and Leannon

- Job : Cartographer

- Bio : Enim deleniti a est reprehenderit et. Commodi sed laborum quos blanditiis. Blanditiis fugiat similique voluptas facere ut enim.

Socials

instagram:

- url : https://instagram.com/lonmraz

- username : lonmraz

- bio : Aliquam id repudiandae aspernatur ex sed quis dolorem. Similique non ex labore earum qui ut aut.

- followers : 5814

- following : 391

facebook:

- url : https://facebook.com/lonmraz

- username : lonmraz

- bio : Perspiciatis beatae officiis molestias asperiores ipsam.

- followers : 2708

- following : 1711

linkedin:

- url : https://linkedin.com/in/lon_dev

- username : lon_dev

- bio : Consequatur eum modi est fugiat animi.

- followers : 6945

- following : 1486

twitter:

- url : https://twitter.com/mrazl

- username : mrazl

- bio : Culpa sint doloremque suscipit. Est doloribus reiciendis veritatis tempora et amet ipsum. Debitis est voluptatem adipisci.

- followers : 5233

- following : 1357