Understanding Robert Maxwell's Net Worth

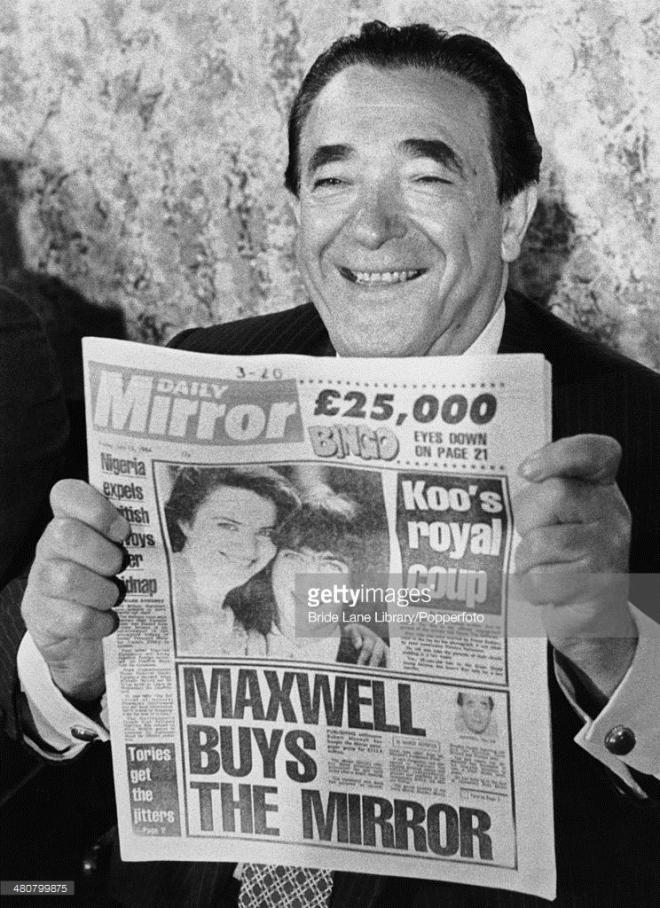

Robert Maxwell, the late British media tycoon and Member of Parliament, possessed a vast fortune that became a subject of much speculation and intrigue. At the time of his mysterious death in 1991, Maxwell's net worth was estimated to be in the billions of pounds. However, subsequent investigations revealed a complex financial picture marked by questionable accounting practices and extensive debts.

The determination of Maxwell's true net worth proved to be a challenging task, as his business empire spanned various industries, including publishing, shipping, and real estate. Moreover, his financial dealings were often shrouded in secrecy, making it difficult to ascertain the full extent of his wealth.

- Unveiling The Profound Impact Of Robert Habecks Age Discoveries And Insights

- Discover The Inspiring Journey Allison Jones Foster A Beacon Of Progress

- Unveiling Penn Badgleys Parents Uncovering Their Influence And Family Dynamics

- Discover The Unstoppable Force Of Anthony Alabi In Professional Basketball

- Unveiling The Truth Jimmy Kimmels Firing Rumors Debunked

The discrepancies between the perceived and actual value of Maxwell's assets led to intense scrutiny and legal battles. His legacy remains tainted by the financial scandals that emerged after his death, serving as a cautionary tale about the potential pitfalls of unchecked ambition and opaque financial practices.

Robert Maxwell's Net Worth

Robert Maxwell, the late British media tycoon and Member of Parliament, possessed a vast fortune that became a subject of much speculation and intrigue. At the time of his mysterious death in 1991, Maxwell's net worth was estimated to be in the billions of pounds. However, subsequent investigations revealed a complex financial picture marked by questionable accounting practices and extensive debts.

- Inflated: Maxwell's net worth was often exaggerated, with his assets overvalued and liabilities understated.

- Hidden Debts: Maxwell concealed significant debts through complex financial maneuvers and offshore accounts.

- Fraudulent Accounting: Maxwell's companies engaged in creative accounting practices to present a rosier financial picture.

- Asset Stripping: Maxwell sold off valuable assets of his companies to raise cash, often at the expense of creditors and shareholders.

- Political Influence: Maxwell used his political connections to shield his business dealings from scrutiny.

- Personal Extravagance: Maxwell lived a lavish lifestyle, spending heavily on luxury properties, yachts, and art.

- Unsecured Loans: Maxwell obtained large unsecured loans from banks, which contributed to his spiraling debts.

- Bankruptcy: Maxwell's companies eventually declared bankruptcy, leaving behind a trail of unpaid creditors.

- Legal Battles: Maxwell's death triggered a series of legal battles over his estate and the true extent of his wealth.

The discrepancies between the perceived and actual value of Maxwell's assets led to intense scrutiny and legal battles. His legacy remains tainted by the financial scandals that emerged after his death, serving as a cautionary tale about the potential pitfalls of unchecked ambition and opaque financial practices.

- Unveiling The Truth Are Paul And Robert Redford Related

- Unveiling Central Cees Wealth Success Investments And Philanthropy

- Unlocking Gender Equality Unveiling The Secrets Of The Rajek Model

- Unveiling The Cinematic Journey Of Diane Farr Discoveries And Insights

- Ashley Force Hood Unlocking The Secrets Of Drag Racing Dominance

| Name | Robert Maxwell |

|---|---|

| Birth | June 10, 1923 |

| Death | November 5, 1991 |

| Nationality | British |

| Occupation | Media tycoon, politician |

| Known for | Ownership of Mirror Group Newspapers, Pergamon Press |

Inflated

The inflation of Robert Maxwell's net worth was a deliberate strategy to project an image of financial stability and success. By overvaluing his assets and understating his liabilities, Maxwell was able to secure loans and investments that would not have been available to him otherwise.

- Overvalued Assets: Maxwell's companies often used creative accounting techniques to inflate the value of their assets. For example, they would value land at its potential development value rather than its current market value.

- Understated Liabilities: Maxwell's companies also engaged in practices to minimize their reported liabilities. For example, they would delay recording expenses or enter into off-balance sheet transactions to keep debt off their books.

- Lack of Transparency: Maxwell's companies were often privately held, which allowed him to control the flow of financial information and prevent scrutiny of his accounting practices.

- Complicit Auditors: Maxwell's auditors failed to exercise due diligence in reviewing his companies' financial statements, which allowed the inflation of his net worth to go undetected for many years.

The inflation of Maxwell's net worth had significant implications for his companies, creditors, and investors. It led to a false sense of security and contributed to the eventual collapse of his business empire. It also eroded trust in the financial markets and highlighted the need for stronger accounting and auditing standards.

Hidden Debts

As Robert Maxwell's business empire expanded rapidly in the 1980s, so too did his reliance on debt financing. However, Maxwell went to great lengths to conceal the true extent of his borrowings, using a complex web of financial maneuvers and offshore accounts.

- Creative Accounting: Maxwell's companies used creative accounting techniques to minimize their reported debt. For example, they would borrow money through subsidiaries that were not consolidated in the group's financial statements.

- Offshore Entities: Maxwell established a network of offshore companies in jurisdictions with lax financial regulations. These entities were used to borrow money and hold assets, making it difficult for creditors to track his debts.

- Personal Guarantees: Maxwell personally guaranteed many of his companies' debts, which allowed him to borrow more money than would have been possible based on the companies' financial strength alone.

- Falsified Documents: In some cases, Maxwell falsified documents to obtain loans or to conceal the true extent of his debts.

The concealment of Maxwell's debts had a significant impact on his net worth. By hiding his liabilities, Maxwell was able to present a more favorable financial picture to investors and creditors. This allowed him to raise more capital and continue expanding his business empire. However, the hidden debts ultimately contributed to the collapse of Maxwell's empire when they became too large to manage.

Fraudulent Accounting

Robert Maxwell's net worth was inflated by the fraudulent accounting practices employed by his companies. These practices were designed to present a more favorable financial picture to investors and creditors, allowing Maxwell to raise more capital and continue expanding his business empire.

- Overstated Assets: Maxwell's companies overstated the value of their assets, such as by valuing land at its potential development value rather than its current market value.

- Understated Liabilities: Maxwell's companies understated their liabilities, such as by delaying the recording of expenses or entering into off-balance sheet transactions.

- Creative Revenue Recognition: Maxwell's companies recognized revenue prematurely or recorded fictitious sales to boost their reported profits.

- Round-Tripping Transactions: Maxwell's companies engaged in round-tripping transactions, which involved selling assets to related entities and then buying them back at a higher price, to artificially inflate their profits.

These fraudulent accounting practices had a significant impact on Maxwell's net worth. By presenting a more favorable financial picture, Maxwell was able to raise more capital and continue expanding his business empire. However, these practices ultimately contributed to the collapse of Maxwell's empire when they became too difficult to sustain.

Asset Stripping

Robert Maxwell's practice of asset stripping played a significant role in inflating his net worth while weakening the financial health of his companies. By selling off valuable assets, such as newspapers, television stations, and real estate, Maxwell was able to generate quick cash to cover his mounting debts and fund his lavish lifestyle.

However, this asset stripping came at a high cost to Maxwell's creditors and shareholders. The sale of valuable assets reduced the earning potential of his companies, making it more difficult for them to repay their debts and pay dividends. In some cases, asset stripping left Maxwell's companies insolvent, leaving creditors with substantial losses.

Maxwell's asset stripping also had a negative impact on the employees of his companies. The sale of newspapers and television stations often led to job losses, as the new owners sought to reduce costs and improve profitability. Maxwell's financial maneuvers left a legacy of broken promises and financial ruin for many individuals and institutions.

Political Influence

The political influence wielded by Robert Maxwell played a significant role in his ability to inflate and maintain his net worth. By cultivating relationships with powerful politicians and government officials, Maxwell was able to shield his business dealings from scrutiny and avoid accountability for his financial improprieties.

One notable example of Maxwell's political influence was his close relationship with British Prime Minister Margaret Thatcher. Maxwell used his ownership of newspapers to support Thatcher's policies and promote her image, while Thatcher in turn provided Maxwell with political favors and protection. This mutually beneficial relationship allowed Maxwell to operate his businesses with less fear of government intervention or investigation.

Maxwell also used his political connections to influence the regulatory environment in which his companies operated. By lobbying politicians and government officials, Maxwell was able to secure favorable treatment for his businesses and avoid regulations that could have threatened his profits. This allowed him to maintain the inflated value of his assets and continue to borrow money to fund his lavish lifestyle.

The connection between Maxwell's political influence and his net worth is clear. By using his political connections to shield his business dealings from scrutiny and avoid accountability, Maxwell was able to inflate and maintain his net worth at levels that were not supported by the underlying financial health of his companies. This ultimately led to the collapse of his business empire and the loss of billions of pounds for investors and creditors.

Personal Extravagance

Robert Maxwell's lavish lifestyle played a significant role in the inflation and eventual collapse of his net worth. His excessive spending on luxury properties, yachts, and art drained his companies of much-needed resources and contributed to the accumulation of unsustainable levels of debt.

Maxwell's personal extravagance was not merely a reflection of his wealth; it was an integral part of his business strategy. By projecting an image of wealth and success, Maxwell was able to attract investors and lenders who were eager to be associated with his empire. This allowed him to raise capital and expand his businesses, even when their financial fundamentals were weak.

However, Maxwell's lavish spending ultimately proved to be his undoing. As his debts mounted and his businesses struggled to generate sufficient cash flow, he was forced to sell off assets and borrow more money to maintain his extravagant lifestyle. This unsustainable cycle eventually led to the collapse of his empire and the loss of billions of pounds for investors and creditors.

The connection between Maxwell's personal extravagance and his net worth is a cautionary tale for business leaders and investors alike. It is a reminder that excessive spending and a lack of financial discipline can have disastrous consequences, even for the most successful and well-connected individuals.

Unsecured Loans

Robert Maxwell's reliance on unsecured loans was a major factor in the inflation of his net worth and the eventual collapse of his business empire. Unsecured loans, which are not backed by collateral, are inherently riskier for lenders and typically carry higher interest rates. Maxwell was able to obtain large unsecured loans from banks due to his personal wealth, political connections, and the inflated value of his assets.

However, as Maxwell's debts mounted and his businesses struggled to generate sufficient cash flow, he became increasingly reliant on unsecured loans to meet his financial obligations. This led to a vicious cycle, as the high interest rates on unsecured loans further drained his companies' resources and made it more difficult for him to repay his debts.

The connection between Maxwell's unsecured loans and his net worth is a cautionary tale for business leaders and investors alike. It is a reminder that excessive borrowing, especially in the form of unsecured loans, can have disastrous consequences. Even for individuals with significant wealth and political connections, unsecured loans can quickly become a burden that is difficult to manage.

Bankruptcy

The bankruptcy of Robert Maxwell's companies was a direct consequence of the unsustainable financial practices that had inflated his net worth. The collapse of his business empire exposed the true extent of his debts and left a trail of unpaid creditors.

- Excessive Debt: Maxwell's companies relied heavily on debt financing, including unsecured loans, to fund their operations and acquisitions. This excessive debt burden became unsustainable as the companies struggled to generate sufficient cash flow to service their obligations.

- Asset Stripping: Maxwell's practice of selling off valuable assets to raise cash further weakened the financial health of his companies. This asset stripping left the companies with fewer revenue-generating assets and made it more difficult to repay their debts.

- Fraudulent Accounting: Maxwell's companies engaged in fraudulent accounting practices to present a rosier financial picture and conceal their true financial condition. This deception misled investors and creditors, contributing to the eventual collapse of the companies.

- Lack of Transparency: Maxwell's companies were often privately held, which allowed him to control the flow of financial information and prevent scrutiny of his accounting practices. This lack of transparency made it difficult for investors and creditors to assess the true financial health of the companies.

The bankruptcy of Maxwell's companies had a significant impact on his net worth. The collapse of his business empire wiped out most of his wealth, leaving him with substantial debts and a damaged reputation.

Legal Battles

The legal battles surrounding Robert Maxwell's estate and the true extent of his wealth played a significant role in determining his net worth and exposing the financial irregularities that had inflated it during his lifetime.

- Contested Debts: After Maxwell's death, numerous creditors came forward to claim debts against his estate, alleging that he had hidden his true liabilities through complex financial maneuvers. These legal battles revealed the extent of Maxwell's undisclosed debts and contributed to the reduction of his net worth.

- Asset Recovery: Maxwell's family and creditors also engaged in legal battles over the recovery of assets that had been sold off or transferred before his death. These battles aimed to recover funds and properties that could be used to satisfy outstanding debts and determine the true extent of Maxwell's wealth.

- Fraud Investigations: Law enforcement agencies and regulatory bodies launched investigations into Maxwell's financial dealings, uncovering evidence of fraudulent accounting practices and other irregularities. These investigations shed light on the methods used by Maxwell to inflate his net worth and led to criminal charges against individuals involved in his business empire.

- Bankruptcy Proceedings: Maxwell's companies were declared bankrupt after his death, leading to complex legal proceedings to liquidate assets and distribute funds to creditors. These proceedings provided a forum for creditors to assert their claims and for investigators to examine the financial records of Maxwell's businesses.

The legal battles surrounding Maxwell's estate and wealth had a profound impact on his net worth, reducing it significantly from the inflated figures reported during his lifetime. These battles exposed the true extent of his debts, uncovered fraudulent accounting practices, and facilitated the recovery of assets for creditors. The legal process served as a means of accountability and transparency, ensuring that the financial irregularities that had inflated Maxwell's net worth were brought to light.

FAQs on Robert Maxwell's Net Worth

This section addresses frequently asked questions regarding Robert Maxwell's net worth, providing concise and informative answers to clarify common misconceptions and concerns.

Question 1: What was Robert Maxwell's estimated net worth at the time of his death?

Initially estimated in the billions of pounds, Maxwell's net worth was later revealed to be significantly inflated due to fraudulent accounting practices and undisclosed debts.

Question 2: How did Maxwell inflate his net worth?

Maxwell employed various tactics to inflate his net worth, including overvaluing assets, understating liabilities, and engaging in creative accounting techniques.

Question 3: What role did asset stripping play in Maxwell's financial dealings?

Maxwell's practice of selling off valuable assets to raise cash weakened his companies' financial health and contributed to his unsustainable debt burden.

Question 4: How did Maxwell's political connections impact his net worth?

Maxwell's close relationships with politicians and government officials allowed him to shield his business dealings from scrutiny and avoid accountability for his financial improprieties.

Question 5: What led to the bankruptcy of Maxwell's companies?

Maxwell's companies declared bankruptcy due to excessive debt, asset stripping, fraudulent accounting, and lack of transparency, which ultimately eroded their financial stability.

Question 6: What was the outcome of the legal battles surrounding Maxwell's estate and wealth?

The legal battles exposed the true extent of Maxwell's debts, uncovered fraudulent accounting practices, and facilitated the recovery of assets for creditors, resulting in a significant reduction in his net worth.

Summary: Robert Maxwell's net worth was inflated through fraudulent practices and questionable financial maneuvers. His excessive spending, reliance on unsecured loans, and lack of transparency ultimately led to the collapse of his business empire and a substantial reduction in his net worth.

Transition to the next article section: The following section will explore the impact of Maxwell's financial improprieties on his legacy and the lessons learned from his business practices.

Tips for Understanding Robert Maxwell's Net Worth

To fully grasp the complexities surrounding Robert Maxwell's net worth, consider the following key tips:

Analyze financial statements critically: Scrutinize financial statements for any irregularities or discrepancies that may indicate inflated asset values or understated liabilities.

Examine debt levels cautiously: Assess the extent of Maxwell's debt obligations, including both secured and unsecured loans, to determine if they were sustainable given his companies' cash flow.

Consider the role of asset stripping: Evaluate the impact of Maxwell's practice of selling off valuable assets to raise cash, as this can weaken the financial health of companies.

Investigate political connections: Examine the influence of Maxwell's political relationships on his ability to secure favorable treatment and avoid scrutiny of his financial dealings.

Understand the consequences of excessive spending: Recognize the unsustainable nature of Maxwell's lavish lifestyle and its contribution to the financial strain on his companies.

Analyze the impact of bankruptcy: Study the legal proceedings and financial implications surrounding the bankruptcy of Maxwell's companies to gain insights into the true extent of his debts and the erosion of his wealth.

By applying these tips, readers can develop a comprehensive understanding of Robert Maxwell's net worth, the factors that inflated it, and the consequences of his financial improprieties.

Conclusion: Robert Maxwell's net worth serves as a cautionary tale about the dangers of unchecked ambition, creative accounting practices, and the lack of transparency in business dealings. By examining the complexities surrounding his financial empire, we gain valuable lessons for evaluating the true worth of individuals and organizations.

Conclusion

The examination of Robert Maxwell's net worth reveals a cautionary tale of unchecked ambition, creative accounting practices, and opaque financial dealings. His ability to inflate his wealth through various questionable methods highlights the importance of thorough financial analysis and the need for transparency in business practices.

The collapse of Maxwell's business empire serves as a reminder of the consequences of unsustainable financial practices and the erosion of trust in individuals and institutions. It underscores the significance of ethical behavior, prudent financial management, and the rule of law in maintaining a healthy and stable economy.

Related Resources:

- Unveiling The Elusive Difference Deadlock Vs Starvation

- Unveiling Lola Tungs Background Discoveries And Insights

- Gene Simmons Weight Unveiling Surprising Truths And Unlocking Key Insights

- Molly Shannons Relationships Uncovering Love Laughter And Inspiration

- Unlocking The Legacy Of Catie Yagher Insights And Discoveries

Detail Author:

- Name : Miss Ava Becker

- Username : owalker

- Email : quitzon.addison@yahoo.com

- Birthdate : 1984-01-12

- Address : 172 Blanda Views Russborough, MS 26671

- Phone : +1-463-352-9956

- Company : Boehm, McClure and Medhurst

- Job : Announcer

- Bio : Nesciunt accusantium vitae dolorem reprehenderit sed. Dolores enim sequi veritatis modi. Corporis molestiae qui at laboriosam necessitatibus nesciunt.

Socials

twitter:

- url : https://twitter.com/hauckm

- username : hauckm

- bio : Aut temporibus accusamus dignissimos vitae odio quibusdam impedit. Quo qui est voluptate eius. Ea aut id nemo minima in repudiandae.

- followers : 4527

- following : 1693

linkedin:

- url : https://linkedin.com/in/hauck2006

- username : hauck2006

- bio : Aut expedita soluta ut accusantium.

- followers : 6327

- following : 423

instagram:

- url : https://instagram.com/monique_official

- username : monique_official

- bio : Et libero ipsum ut veniam. Nobis qui est ex ut qui. Debitis voluptatum quod assumenda aut.

- followers : 534

- following : 1237

facebook:

- url : https://facebook.com/monique_id

- username : monique_id

- bio : Praesentium recusandae nesciunt omnis sint.

- followers : 5551

- following : 2680