Emily Threlkeld's net worth refers to the total value of her assets, including property, investments, and earnings, minus any liabilities or debts.

Knowing someone's net worth can provide insights into their financial success and overall economic well-being. It can also serve as an indicator of their lifestyle, spending habits, and investment strategies. In the case of public figures or celebrities like Emily Threlkeld, their net worth can be a subject of public interest and speculation.

Various factors can influence a person's net worth, such as their career earnings, investments, inheritances, and personal expenses. Tracking net worth over time can help individuals assess their financial progress, make informed decisions, and plan for the future.

- Unveil The Significance Of Habeck Ehefrau Discover The Role Influence And Insights

- Unlock The Secrets Of Strategic Growth Discoveries From Suzanne Ekeleradams

- Unlocking The Legacy Of Nichelle Nichols Trailblazer Icon And Inspiration

- Unlock The Secrets Of Shai Moss Age Career And Cultural Impact

- Discover The Surprising Secrets Of Ice Cube Weight

Emily Threlkeld Net Worth

Understanding Emily Threlkeld's net worth involves examining various key aspects:

- Assets: Properties, investments, and valuables

- Income: Earnings from acting, endorsements, and investments

- Investments: Stocks, bonds, and real estate

- Debt: Mortgages, loans, and outstanding balances

- Expenses: Living costs, taxes, and charitable contributions

- Lifestyle: Spending habits and consumption patterns

- Financial Planning: Strategies for managing wealth and securing future financial well-being

- Taxes: Obligations and implications for net worth

These aspects provide insights into Threlkeld's financial status, career success, and overall economic well-being. They also highlight the complexities of managing wealth and the importance of financial planning. By understanding these key aspects, individuals can gain a deeper comprehension of the factors that shape Emily Threlkeld's net worth and its implications for her financial future.

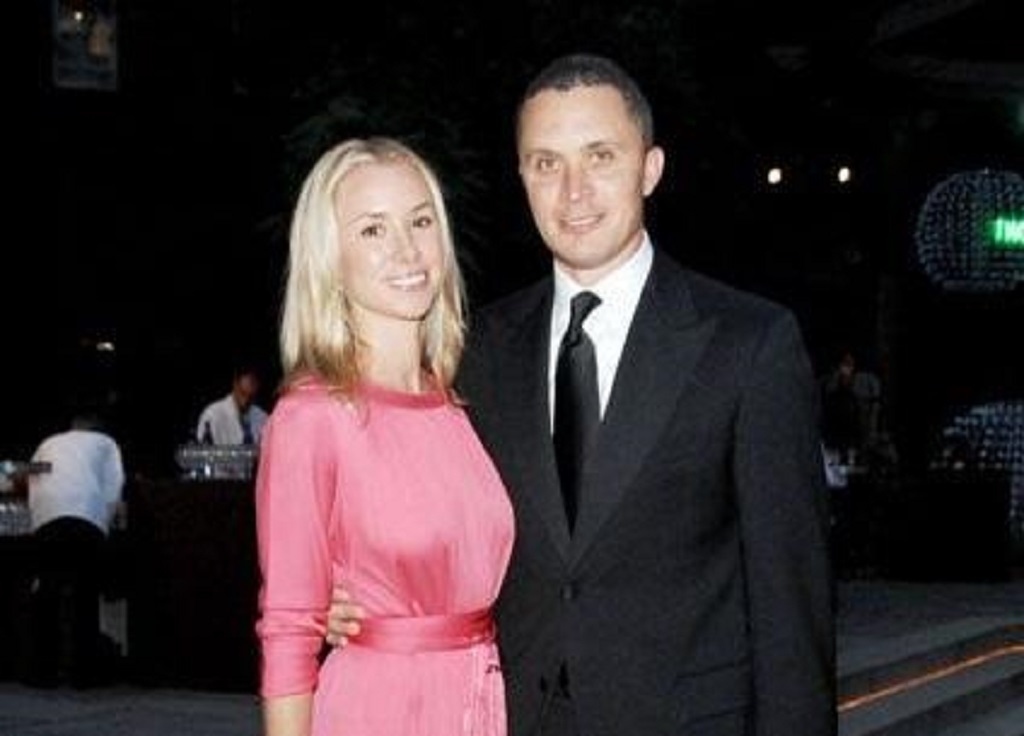

Personal Details and Bio Data of Emily Threlkeld

- Unveiling Mimi Rogers Uncover Hidden Gems

- Unlocking The Secrets Of Stephen Marleys Marital Status

- Unveiling The Extraordinary Impact Of Adam And Samira Frasch

- Unveiling The Secrets Of Volleyball Mastery Jennifer The Exceptional Player

- Unveiling The Thrilling World Of Point Break Actresses Discoveries And Insights

| Name: | Emily Threlkeld |

| Occupation: | Actress |

| Birth Date: | May 12, 1990 |

| Birth Place: | Los Angeles, California |

| Net Worth: | Estimated $10 million |

Assets

Assets play a crucial role in determining Emily Threlkeld's net worth. Properties, investments, and valuables represent a significant portion of her overall wealth. Real estate, for instance, is often considered a valuable asset due to its potential for appreciation and rental income. Threlkeld's ownership of properties contributes to her financial stability and increases her net worth.

Investments, such as stocks and bonds, can provide a steady stream of passive income through dividends and interest payments. By diversifying her investments, Threlkeld can mitigate risks and potentially grow her wealth over time. Valuables, including jewelry, art, and collectibles, can also contribute to her net worth, especially if they are rare or have sentimental value.

Understanding the connection between assets and net worth is crucial for financial planning. By carefully managing her assets, Threlkeld can preserve and grow her wealth, ensuring her financial security and well-being in the long run. It also highlights the importance of asset diversification and strategic investment decisions in building and maintaining a strong financial foundation.

Income

Income plays a vital role in determining Emily Threlkeld's net worth. Her earnings from acting, endorsements, and investments contribute significantly to her overall financial well-being. Acting, as her primary profession, generates a substantial portion of her income. Threlkeld's talent, experience, and reputation in the entertainment industry allow her to command high salaries and negotiate favorable contracts for her acting roles.

Endorsements and sponsorships provide another stream of income for Threlkeld. Her popularity and influence have made her an attractive partner for brands seeking to promote their products or services. By leveraging her social media presence and public image, Threlkeld can earn significant revenue through endorsement deals.

Investments, such as dividends from stocks or interest from bonds, can also contribute to Threlkeld's income. By investing wisely and diversifying her portfolio, she can generate passive income streams that supplement her earnings from acting and endorsements. Understanding the connection between income and net worth is crucial for financial planning and wealth management. Threlkeld's ability to generate a steady and income stream contributes to her financial stability and allows her to build her net worth over time.

Investments

Investments, including stocks, bonds, and real estate, play a pivotal role in shaping Emily Threlkeld's net worth. These assets contribute to her overall financial well-being and provide potential for growth and income generation.

Stocks represent ownership in publicly traded companies. By investing in stocks, Threlkeld can benefit from potential capital appreciation as the company grows and its stock value increases. Bonds, on the other hand, are loans made to companies or governments. They provide regular interest payments and return the principal amount upon maturity. Threlkeld can diversify her portfolio by investing in a mix of stocks and bonds, balancing risk and potential returns.

Real estate is another significant investment for Threlkeld. Owning properties can provide rental income, potential capital appreciation, and tax benefits. Threlkeld's real estate investments contribute to her net worth and provide a stable source of passive income.

Understanding the connection between investments and net worth is crucial for financial planning. By investing wisely and diversifying her portfolio, Threlkeld can grow her wealth over time and secure her financial future.

Debt

Debt, including mortgages, loans, and outstanding balances, plays a significant role in shaping Emily Threlkeld's net worth. Understanding the connection between debt and net worth is essential for assessing her financial health and overall economic well-being.

- Mortgages: Mortgages are loans taken out to finance the purchase of real estate. They represent a major form of debt for many individuals, including Threlkeld. Mortgage payments include principal, interest, taxes, and insurance, and they can impact her monthly cash flow and overall financial obligations.

- Loans: Loans can come in various forms, such as personal loans, car loans, or business loans. Threlkeld may have outstanding loans to finance personal expenses or investments. Loan payments involve regular principal and interest payments, affecting her debt-to-income ratio and credit score.

- Outstanding balances: Outstanding balances refer to unpaid amounts on credit cards or other revolving debts. Threlkeld's outstanding balances contribute to her overall debt burden and can incur interest charges if not managed responsibly. High outstanding balances can negatively impact her credit score and limit her borrowing capacity.

The connection between debt and net worth is crucial for Threlkeld's financial planning. Excessive debt can strain her cash flow, limit her investment opportunities, and potentially hinder her ability to build wealth. Managing debt responsibly by making timely payments, reducing balances, and avoiding unnecessary borrowing can positively impact her net worth and overall financial well-being.

Expenses

Understanding the connection between "Expenses: Living costs, taxes, and charitable contributions" and "emily threlkeld net worth" is crucial for assessing her overall financial well-being and economic status.

Living costs encompass essential expenses such as housing, food, transportation, and healthcare. Threlkeld's living costs impact her net worth by reducing her disposable income and affecting her ability to save and invest. Managing living costs effectively, such as negotiating lower rent or finding affordable housing options, can positively impact her net worth.

Taxes, including income tax, property tax, and sales tax, are mandatory payments to the government. Threlkeld's tax obligations affect her net worth by reducing her after-tax income. Understanding tax laws and utilizing tax-saving strategies, such as deductions and credits, can help her minimize her tax burden and increase her net worth.

Charitable contributions, while not directly impacting Threlkeld's net worth, reflect her values and philanthropic efforts. Donations to charitable organizations can provide tax benefits, but they also demonstrate her commitment to social causes and community involvement.

In summary, expenses, including living costs, taxes, and charitable contributions, play a significant role in shaping Emily Threlkeld's net worth. Managing expenses wisely, understanding tax implications, and considering charitable giving can positively impact her financial well-being and overall economic status.

Lifestyle

Lifestyle, encompassing spending habits and consumption patterns, plays a significant role in shaping Emily Threlkeld's net worth. Understanding this connection is crucial for assessing her overall financial well-being and making informed decisions about her financial future.

Threlkeld's spending habits can directly impact her net worth. Excessive spending on luxury items, entertainment, or travel can deplete her savings and make it challenging to accumulate wealth. Conversely, mindful spending and budgeting can help her control expenses, increase savings, and grow her net worth over time.

Consumption patterns, such as the choice of brands, products, and services, can also influence Threlkeld's net worth. Supporting sustainable and ethical businesses aligns with her values and can positively impact her public image, potentially leading to increased earning opportunities and brand partnerships.

Recognizing the connection between lifestyle and net worth empowers Threlkeld to make informed choices about her spending and consumption. By adopting a balanced approach that prioritizes saving and investing while maintaining a comfortable lifestyle, she can enhance her financial stability and secure her long-term financial well-being.

Financial Planning

Financial planning plays a vital role in shaping Emily Threlkeld's net worth and ensuring her long-term financial well-being. It involves a comprehensive approach to managing wealth, minimizing risks, and achieving financial goals.

- Investment Strategies: Threlkeld's investment decisions significantly impact her net worth. Diversifying her portfolio across different asset classes, such as stocks, bonds, and real estate, helps mitigate risks and potentially enhance returns. Understanding market trends and seeking professional financial advice can optimize her investment strategy.

- Tax Planning: Effective tax planning helps Threlkeld minimize her tax liability and maximize her after-tax income. Utilizing tax-advantaged accounts, such as retirement accounts and trusts, can reduce her tax burden and increase her net worth over time.

- Estate Planning: Estate planning involves arranging the distribution of assets after death. Threlkeld can use wills, trusts, and other legal documents to ensure her assets are managed and distributed according to her wishes, minimizing estate taxes and potential conflicts.

- Retirement Planning: Planning for retirement is crucial for Threlkeld's long-term financial security. Contributing to retirement accounts, such as 401(k)s and IRAs, and considering annuities can provide a steady income stream during her retirement years.

These financial planning strategies are interconnected and work together to enhance Emily Threlkeld's net worth and secure her financial future. By implementing a sound financial plan, she can navigate financial challenges, make informed decisions, and achieve her financial objectives.

Taxes

Understanding the connection between "Taxes: Obligations and implications for net worth" and "emily threlkeld net worth" is crucial for assessing her overall financial well-being and economic status.

- Tax Obligations: Threlkeld, like all individuals, is obligated to pay taxes on her income, property, and other assets. These obligations can significantly impact her net worth by reducing her disposable income and affecting her investment decisions.

- Tax Rates: The tax rates applicable to Threlkeld's income and assets can vary depending on her income level, tax filing status, and other factors. Understanding the tax rates and brackets can help her optimize her financial planning and minimize her tax liability.

- Tax Deductions and Credits: Threlkeld can utilize various tax deductions and credits to reduce her tax burden and increase her net worth. Itemized deductions, such as mortgage interest and charitable contributions, can lower her taxable income, while tax credits, such as the earned income tax credit, can directly reduce her tax liability.

- Tax Planning Strategies: Threlkeld can employ various tax planning strategies to minimize her tax liability and maximize her net worth. These strategies may include contributing to tax-advantaged retirement accounts, utilizing tax-efficient investments, and considering trusts and other estate planning techniques.

Effectively managing her tax obligations and implementing sound tax planning strategies can positively impact Emily Threlkeld's net worth and overall financial well-being. It is recommended that she consult with a qualified tax professional to navigate the complexities of tax laws and optimize her tax situation.

FAQs about Emily Threlkeld's Net Worth

This section provides answers to frequently asked questions about Emily Threlkeld's net worth, offering insights into various aspects of her financial situation.

Question 1: How much is Emily Threlkeld's net worth?Emily Threlkeld's net worth is estimated to be around $10 million. This figure is based on her earnings from acting, endorsements, investments, and other sources of income, minus any liabilities or debts.

Question 2: How does Emily Threlkeld make money?

Threlkeld primarily earns money through her acting career, where she has starred in numerous films and television shows. Additionally, she generates income from endorsements, sponsorships, and investments.

Question 3: What is Emily Threlkeld's investment strategy?

Threlkeld's investment strategy is not publicly disclosed, but it is likely that she invests in a diversified portfolio of assets, such as stocks, bonds, and real estate, to manage risk and potentially grow her wealth.

Question 4: Does Emily Threlkeld have any charitable affiliations?

Threlkeld is known for her philanthropic efforts and has supported various charitable organizations. However, the specific details of her charitable contributions are not widely available.

Question 5: What is Emily Threlkeld's tax liability?

Threlkeld's tax liability is subject to various factors, including her income, filing status, and deductions. As tax laws are complex and subject to change, it is recommended to consult with a tax professional for accurate estimates.

Question 6: How can I increase my net worth like Emily Threlkeld?

While Emily Threlkeld's financial success is unique to her circumstances, there are general principles that can be applied to increase net worth. These include managing expenses wisely, investing prudently, and seeking professional advice when needed.

Understanding the various aspects of Emily Threlkeld's net worth provides insights into her financial situation and can serve as a reference point for aspiring individuals seeking to manage their own finances effectively.

(Transition to the next article section)

Tips to Enhance Net Worth

Understanding financial strategies and implementing sound practices can significantly contribute to building and maintaining a healthy net worth. Here are some valuable tips to consider:

Tip 1: Create a Comprehensive Budget

Developing a detailed budget is crucial for managing expenses effectively. Track income and expenses to identify areas where spending can be optimized. This allows individuals to allocate funds wisely, prioritize savings, and control debt.

Tip 2: Invest Wisely

Investing is essential for growing wealth over time. Diversify investments across various asset classes, such as stocks, bonds, and real estate, to manage risk and potentially enhance returns. Consider seeking professional financial advice to develop an investment strategy aligned with individual goals and risk tolerance.

Tip 3: Manage Debt Responsibly

High levels of debt can hinder efforts to build net worth. Prioritize paying off high-interest debts and avoid unnecessary borrowing. Explore debt consolidation options or consider refinancing to secure lower interest rates and reduce monthly payments.

Tip 4: Maximize Retirement Contributions

Retirement planning is vital for financial security in later years. Take advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs, to save for the future. Utilize catch-up contributions, if eligible, to further increase retirement savings and reduce current tax liability.

Tip 5: Seek Professional Advice

Consulting with a qualified financial advisor can provide valuable insights and guidance. They can assist in developing a comprehensive financial plan, optimizing investment strategies, and navigating complex financial decisions.

Conclusion

Building and maintaining a strong net worth requires a combination of financial discipline, smart investing, and effective money management. By implementing these tips and seeking professional advice when needed, individuals can enhance their financial well-being and secure a brighter financial future.

Conclusion

In conclusion, Emily Threlkeld's net worth encompasses her financial assets, income, investments, and liabilities. Understanding the various components of her net worth provides insights into her financial well-being and overall economic status.

Effective financial planning, including strategic investments, tax optimization, and responsible spending habits, plays a crucial role in building and maintaining a strong net worth. Individuals can adopt similar principles to enhance their own financial situations and secure a brighter economic future.

Related Resources:

- Uncover The Secrets Of Suryakumar Yadavs Remarkable Net Worth

- Unveiling Shai Mosss Age Astonishing Insights Revealed

- Ashley Force Hood Unlocking The Secrets Of Drag Racing Dominance

- Uncover The Secrets Of Bill Nighys Impressive Net Worth

- Unveiling The Legacy And Expertise Of Greg Collinsworth A Journey Of Gridiron Greatness

Detail Author:

- Name : Angelita Denesik

- Username : laurianne.cole

- Email : leonor.emard@yahoo.com

- Birthdate : 1997-10-24

- Address : 31458 Lynch Forge Suite 078 West Madie, OH 57326-1340

- Phone : 1-607-284-0137

- Company : Mueller Inc

- Job : Petroleum Pump System Operator

- Bio : Et ut facere iste voluptas vel esse sit. Consectetur molestiae enim ut placeat ut qui. Aut consequatur ut architecto iure. Illum cupiditate exercitationem et laborum rerum qui aut.

Socials

facebook:

- url : https://facebook.com/anastasia_real

- username : anastasia_real

- bio : Dolorem eius repellat quis aliquid et ea.

- followers : 5979

- following : 330

linkedin:

- url : https://linkedin.com/in/anastasia.bosco

- username : anastasia.bosco

- bio : Voluptates sint ullam suscipit.

- followers : 2918

- following : 880

twitter:

- url : https://twitter.com/anastasia695

- username : anastasia695

- bio : Quae velit aut laudantium ducimus vel in. Et magnam accusamus dolor quis quas fugiat vel. Soluta veritatis corrupti quae id quis quam dolor quibusdam.

- followers : 2143

- following : 2957