Kra Pin Certificate Application And

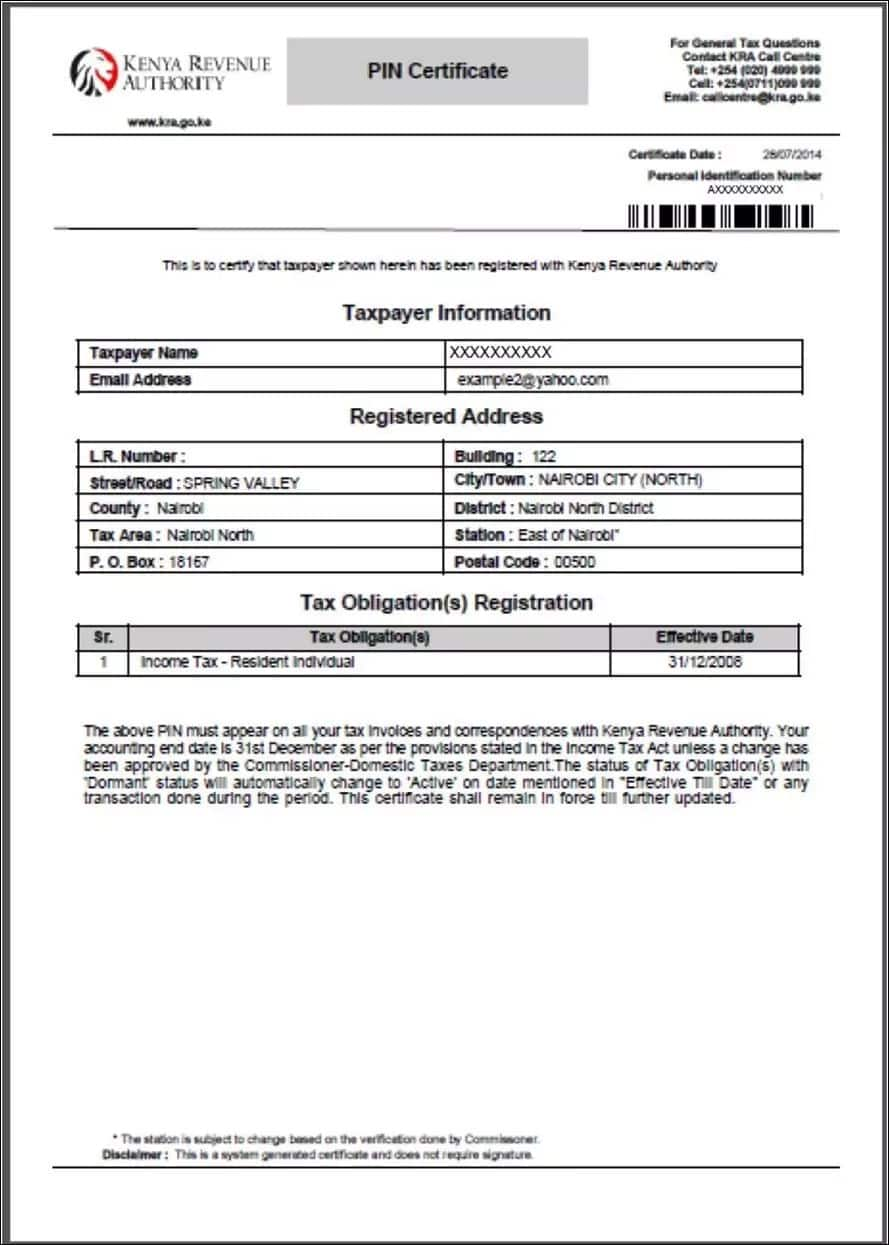

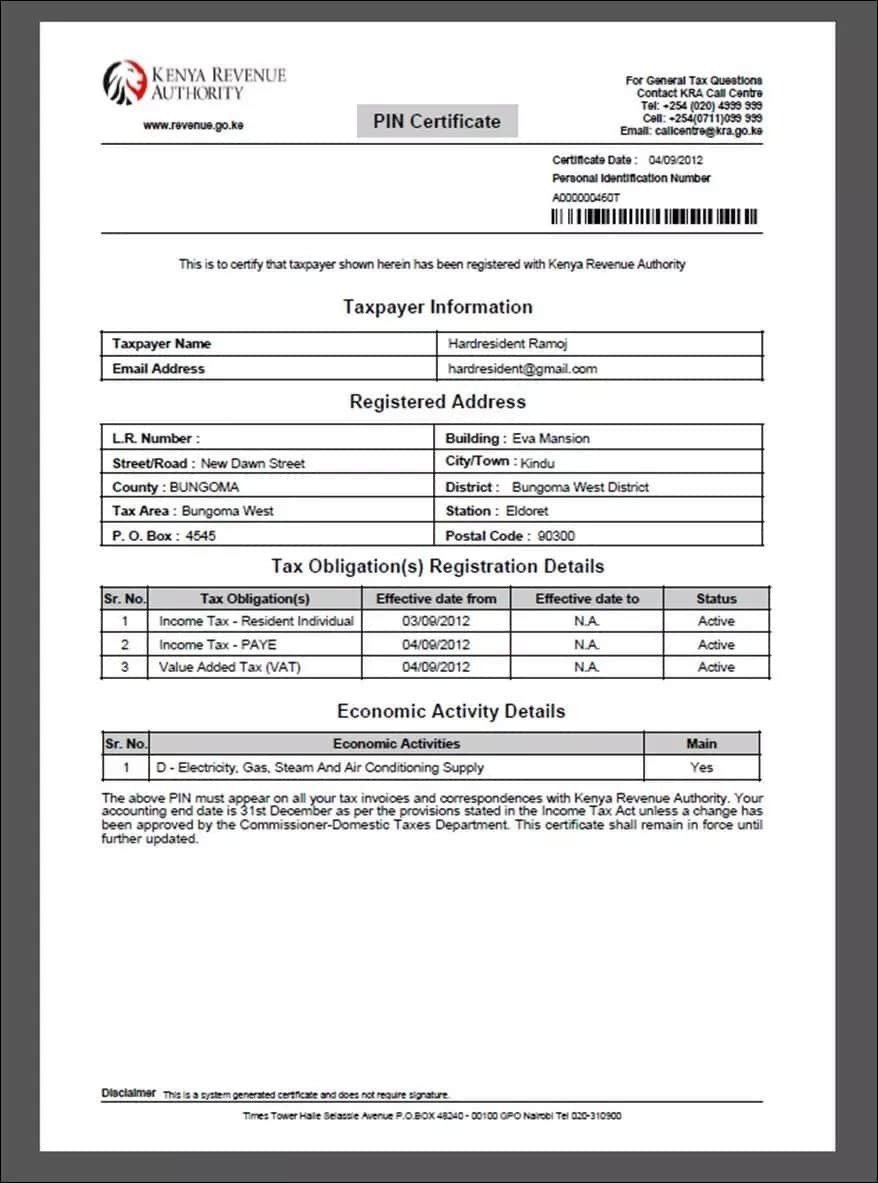

The Kenya Revenue Authority (KRA) Personal Identification Number (PIN) is a unique identifier assigned to all taxpayers in Kenya. The KRA PIN Certificate is an official document that contains the taxpayer's PIN and other personal information. It is required for various transactions, such as filing tax returns, opening a bank account, or purchasing property. To apply for a KRA PIN Certificate, you can either visit a KRA office or apply online through the iTax portal.

There are several benefits to having a KRA PIN Certificate. It allows you to easily file your tax returns and track your tax payments. It also makes it easier to open a bank account or purchase property. Additionally, having a KRA PIN Certificate can help you avoid penalties and interest charges for late or incorrect tax payments.

- Unlocking The Secrets Of Kelly Ripas Educational Triumph

- Unveiling The Truth Jimmy Kimmels Fate And The Future Of Comedy

- Unveiling The Enchanting World Of Stella Luna Pompeo Ivery

- Unveiling Central Cees Wealth Success Investments And Philanthropy

- Unveiling The Enchanting Story Of Lola Tung A Journey Of Talent And Inspiration

If you are a resident of Kenya and are required to file taxes, it is important to apply for a KRA PIN Certificate. You can apply for a KRA PIN Certificate online or by visiting a KRA office. The application process is simple and straightforward, and you will receive your certificate within a few days.

Kra Pin Certificate Application And

The Kenya Revenue Authority (KRA) Personal Identification Number (PIN) is a unique identifier assigned to all taxpayers in Kenya. The KRA PIN Certificate is an official document that contains the taxpayer's PIN and other personal information. It is required for various transactions, such as filing tax returns, opening a bank account, or purchasing property.

- Requirement: A KRA PIN Certificate is required for various transactions in Kenya, including filing tax returns, opening a bank account, and purchasing property.

- Application: You can apply for a KRA PIN Certificate online or by visiting a KRA office. The application process is simple and straightforward.

- Benefits: Having a KRA PIN Certificate makes it easier to file your tax returns, track your tax payments, and open a bank account or purchase property.

- Importance: A KRA PIN Certificate is an important document that can help you avoid penalties and interest charges for late or incorrect tax payments.

- Validity: A KRA PIN Certificate is valid for five years from the date of issue.

- Renewal: You can renew your KRA PIN Certificate online or by visiting a KRA office.

- Replacement: If your KRA PIN Certificate is lost or stolen, you can apply for a replacement certificate.

- Fees: There is no fee to apply for or renew a KRA PIN Certificate.

- Status: You can check the status of your KRA PIN Certificate application online.

Overall, the KRA PIN Certificate is an important document that can help you meet your tax obligations and access various financial services in Kenya. It is easy to apply for and renew, and there is no fee.

- Unveiling The Real Story Behind Olivia Casta Real Name

- Unveiling Nolan Shannon Chestnuts Path To Nba Stardom

- Uncover Giannina Gibellis Net Worth And Financial Secrets

- Roger Stones Wife Unveiling The Enigma Behind The Political Powerhouse

- Milo Otis Animal Cruelty Uncovering The Horrific Truth And Path To Prevention

Requirement

The KRA PIN Certificate is a crucial document for individuals and businesses operating in Kenya. It serves as a unique identifier for taxpayers and is required for a wide range of transactions, including filing tax returns, opening bank accounts, and purchasing property.

- Tax Compliance: Filing tax returns is a legal obligation for taxpayers in Kenya. The KRA PIN Certificate is essential for this process, as it allows individuals and businesses to declare their income and pay their taxes accordingly. Without a valid KRA PIN Certificate, taxpayers may face penalties and legal consequences.

- Financial Transactions: Opening a bank account in Kenya typically requires the presentation of a KRA PIN Certificate. Banks use this document to verify the identity of account holders and ensure compliance with anti-money laundering and know-your-customer regulations. A KRA PIN Certificate provides assurance that the account holder is a registered taxpayer and meets the necessary legal requirements.

- Property Transactions: Purchasing property in Kenya involves various legal and financial processes. One of the key requirements is the provision of a KRA PIN Certificate. This document helps to identify the property owner for tax purposes and ensures that all necessary taxes and fees are paid during the transaction.

Overall, the requirement for a KRA PIN Certificate in various transactions in Kenya underscores its importance as a tool for tax compliance, financial transparency, and legal documentation. Obtaining a KRA PIN Certificate is a crucial step for individuals and businesses to fulfill their legal obligations, access essential financial services, and participate fully in Kenya's economic system.

Application

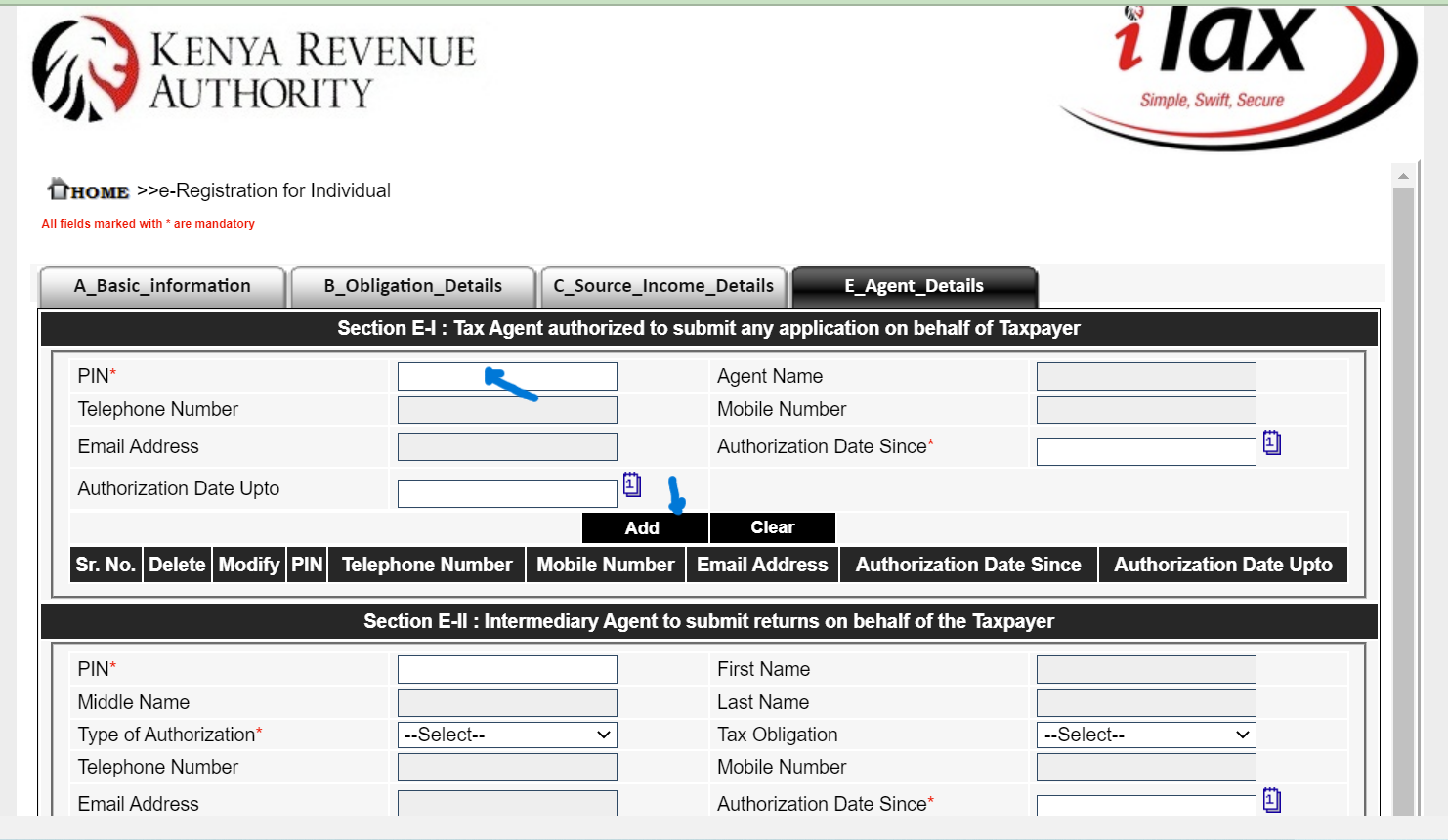

The application process for a KRA PIN Certificate is straightforward, providing convenience and accessibility to individuals and businesses. Applying online through the iTax portal allows for remote submission, eliminating the need for physical visits to KRA offices. Alternatively, visiting a KRA office offers personalized assistance, especially for those who prefer in-person guidance or have specific inquiries.

The simplicity of the application process contributes to the overall efficiency of obtaining a KRA PIN Certificate. The clear instructions and user-friendly interface of the online portal make it easy for applicants to navigate and complete the application. KRA offices are adequately staffed with knowledgeable personnel who provide support and ensure a smooth application experience.

The importance of the application process lies in its role as the gateway to acquiring a KRA PIN Certificate. Without a valid application, individuals and businesses cannot obtain this crucial document, which is essential for tax compliance, financial transactions, and property dealings in Kenya. The straightforward nature of the application process ensures that a wider range of taxpayers can easily register and fulfill their tax obligations.

Benefits

The benefits associated with possessing a KRA PIN Certificate extend beyond mere compliance with tax regulations. It plays a multifaceted role in enhancing financial management and facilitating access to essential services.

- Simplified Tax Filing: With a KRA PIN Certificate, individuals and businesses can effortlessly file their tax returns online through the iTax portal. This eliminates the need for manual submissions and reduces the risk of errors, ensuring timely and accurate tax filing.

- Convenient Tax Payment Tracking: The KRA PIN Certificate serves as a central reference point for tracking tax payments. Taxpayers can easily access their payment history and verify the status of their tax obligations, enabling better financial planning and avoiding potential penalties for late payments.

- Streamlined Bank Account Opening: When opening a bank account in Kenya, the presentation of a KRA PIN Certificate is mandatory. It facilitates verification of the account holder's identity and confirms their tax compliance status, ensuring adherence to anti-money laundering regulations and promoting financial transparency.

- Facilitated Property Transactions: Engaging in property transactions, such as buying or selling land or buildings, requires the provision of a KRA PIN Certificate. This document serves as proof of tax compliance and enables the government to track property ownership, ensuring the proper collection of taxes and reducing the risk of fraudulent transactions.

In summary, obtaining a KRA PIN Certificate offers numerous benefits that extend beyond tax compliance. It simplifies tax filing, enables convenient tracking of tax payments, facilitates the opening of bank accounts, and plays a crucial role in property transactions. These advantages underscore the importance of the KRA PIN Certificate as a vital tool for effective financial management and participation in Kenya's economic system.

Importance

The KRA PIN Certificate plays a critical role in ensuring tax compliance and avoiding penalties. Without a valid KRA PIN Certificate, individuals and businesses may face significant consequences for late or incorrect tax payments.

Penalties for late tax payments can vary depending on the specific circumstances, but generally involve a percentage of the outstanding tax liability. Interest charges may also apply, which can further increase the amount owed to the tax authority. These penalties and interest charges can represent a substantial financial burden, especially for businesses with large tax liabilities.

Obtaining a KRA PIN Certificate is a crucial step in fulfilling tax obligations and avoiding these penalties. The application process is relatively straightforward and can be completed online or by visiting a KRA office. By obtaining a KRA PIN Certificate, individuals and businesses can ensure that their tax payments are processed accurately and on time, reducing the risk of penalties and interest charges.

In summary, the importance of the KRA PIN Certificate lies in its ability to help taxpayers avoid penalties and interest charges for late or incorrect tax payments. By obtaining a KRA PIN Certificate and fulfilling their tax obligations, individuals and businesses can maintain compliance with tax regulations and protect their financial interests.

Validity

The validity period of a KRA PIN Certificate is closely connected to the "Kra Pin Certificate Application And" process, impacting the frequency of application and renewal, as well as the overall tax administration system in Kenya.

- Period of Validity:

The five-year validity period establishes a clear timeframe for the use of a KRA PIN Certificate. Taxpayers must ensure that their certificates are renewed before the expiration date to maintain compliance and avoid any interruptions in their tax-related activities.

- Renewal Process:

The validity period necessitates a renewal process, ensuring that the information on the certificate remains up-to-date and accurate. This process helps maintain the integrity of the tax system by keeping taxpayer records current.

- Tax Compliance:

The validity period influences tax compliance by setting a defined window for which the certificate is valid. This encourages taxpayers to regularly review and update their information, promoting overall compliance and reducing the risk of errors or discrepancies.

- Administrative Efficiency:

The five-year validity period balances the need for regular renewal with administrative efficiency. It allows taxpayers sufficient time to use their certificates without the need for overly frequent renewals, reducing the burden on both taxpayers and the tax authority.

In conclusion, the validity period of a KRA PIN Certificate plays a crucial role in the "Kra Pin Certificate Application And" process, ensuring tax compliance, facilitating administrative efficiency, and maintaining the integrity of Kenya's tax system.

Renewal

The renewal process for a KRA PIN Certificate is an integral part of the "Kra Pin Certificate Application And" process, ensuring the continued validity and accuracy of taxpayer information within the Kenyan tax system.

- Maintaining Compliance:

Renewing a KRA PIN Certificate before its expiration date is crucial for maintaining tax compliance. A valid certificate allows taxpayers to continue filing tax returns, making tax payments, and engaging in other tax-related activities without interruptions or penalties.

- Updating Information:

The renewal process provides an opportunity for taxpayers to review and update their personal and tax-related information. This ensures that the KRA has the most current and accurate data, which is essential for efficient tax administration and effective service delivery.

- Convenience and Accessibility:

The availability of online and in-person renewal options provides convenience and accessibility to taxpayers. Taxpayers can choose the method that best suits their needs and circumstances, ensuring a smooth and hassle-free renewal process.

- Administrative Efficiency:

The renewal process contributes to the overall efficiency of the tax administration system. Regular renewal ensures that taxpayer records are up-to-date, reducing the risk of errors and discrepancies, and facilitating efficient processing of tax-related transactions.

In conclusion, the renewal process for a KRA PIN Certificate is an important aspect of the "Kra Pin Certificate Application And" process, enabling taxpayers to maintain compliance, update their information, and contribute to the effectiveness and efficiency of Kenya's tax system.

Replacement

Within the context of "Kra Pin Certificate Application And", the provision for certificate replacement plays a significant role in ensuring the continuity and integrity of taxpayer records and tax administration processes.

- Preserving Taxpayer Identity:

A replacement certificate maintains the taxpayer's unique identification within the tax system, preventing disruptions in tax-related activities due to lost or stolen certificates. This ensures seamless continuation of tax obligations and entitlements.

- Safeguarding Tax Records:

Applying for a replacement certificate safeguards the taxpayer's tax records and history. The reissued certificate contains the same information as the original, ensuring that the taxpayer's tax-related information remains intact and accessible.

- Preventing Fraud and Misuse:

Lost or stolen certificates can potentially fall into the wrong hands, increasing the risk of fraudulent activities or misuse. Applying for a replacement certificate invalidates the original, mitigating these risks and protecting the taxpayer's financial and legal interests.

- Maintaining Compliance:

A valid KRA PIN Certificate is essential for tax compliance. By providing a mechanism for certificate replacement, the tax authority enables taxpayers to maintain compliance even in the event of lost or stolen certificates, avoiding penalties or legal consequences.

In summary, the provision for KRA PIN Certificate replacement is an integral part of the "Kra Pin Certificate Application And" process, ensuring the preservation of taxpayer identity, safeguarding tax records, preventing fraud and misuse, and facilitating continued tax compliance.

Fees

The absence of fees associated with KRA PIN Certificate application and renewal significantly impacts the "Kra Pin Certificate Application And" process and tax administration in Kenya.

Firstly, it promotes accessibility and inclusivity within the tax system. By eliminating financial barriers, the government ensures that all taxpayers, regardless of their economic status, can obtain and maintain a KRA PIN Certificate. This fosters a sense of fairness and equity, encouraging voluntary tax compliance and broadening the tax base.

Furthermore, the absence of fees simplifies the application and renewal process, making it less burdensome for taxpayers. This streamlined approach reduces the potential for delays or complications, allowing taxpayers to fulfill their tax obligations efficiently and conveniently. The ease of obtaining and renewing KRA PIN Certificates also contributes to the overall effectiveness of the tax administration system, as taxpayers are more likely to register and remain compliant.

In summary, the lack of fees for KRA PIN Certificate application and renewal is a crucial component of the "Kra Pin Certificate Application And" process. It enhances accessibility, simplifies compliance, and supports the efficient functioning of Kenya's tax system.

Status

The ability to check the status of a KRA PIN Certificate application online is a crucial component of the "Kra Pin Certificate Application And" process, offering several key benefits to taxpayers in Kenya.

Firstly, it enhances transparency and accountability within the tax administration system. Taxpayers can proactively monitor the progress of their applications, reducing uncertainties and delays. The online status tracking system provides real-time updates, allowing applicants to make informed decisions and take necessary actions if required.

Furthermore, the online status checking facility promotes convenience and accessibility. Taxpayers can access the system from anywhere with an internet connection, eliminating the need for physical visits to KRA offices. This is particularly beneficial for individuals residing in remote areas or with limited mobility, ensuring equal opportunities for all taxpayers to obtain their KRA PIN Certificates.

In summary, the ability to check the status of a KRA PIN Certificate application online is an integral part of the "Kra Pin Certificate Application And" process. It enhances transparency, accountability, convenience, and accessibility, contributing to an efficient and taxpayer-centric tax administration system in Kenya.

FAQs on Kra Pin Certificate Application And

This section provides answers to frequently asked questions (FAQs) regarding the "Kra Pin Certificate Application And" process in Kenya.

Question 1: What is a KRA PIN Certificate?A KRA PIN Certificate is an official document issued by the Kenya Revenue Authority (KRA) that contains a unique Personal Identification Number (PIN) assigned to each taxpayer in Kenya. It is used for identification and tax compliance purposes.

Question 2: Why do I need a KRA PIN Certificate?A KRA PIN Certificate is required for various transactions in Kenya, including filing tax returns, opening a bank account, purchasing property, and conducting business.

Question 3: How do I apply for a KRA PIN Certificate?You can apply for a KRA PIN Certificate online through the iTax portal or by visiting a KRA office.

Question 4: What documents do I need to apply for a KRA PIN Certificate?The required documents for KRA PIN Certificate application may vary depending on your circumstances. Generally, you will need to provide proof of identity (e.g., national ID card, passport) and proof of residence (e.g., utility bill, bank statement).

Question 5: How long does it take to get a KRA PIN Certificate?The processing time for a KRA PIN Certificate application may vary, but it typically takes a few days to several weeks.

Question 6: What should I do if my KRA PIN Certificate is lost or stolen?If your KRA PIN Certificate is lost or stolen, you should report it to KRA immediately and apply for a replacement certificate.

Summary: Obtaining a KRA PIN Certificate is an essential step for tax compliance and various financial transactions in Kenya. The application process is generally straightforward, and the certificate is valid for five years. If you have any further questions or require assistance, please visit a KRA office or contact the KRA customer service.Transition to the next article section:

To learn more about the importance and benefits of obtaining a KRA PIN Certificate, continue reading the following sections.

Tips for a Successful "Kra Pin Certificate Application And" Process

Obtaining a KRA PIN Certificate is a crucial step for tax compliance and various financial transactions in Kenya. To ensure a smooth and successful application process, consider the following tips:

Tip 1: Gather the Necessary Documents: Before applying for a KRA PIN Certificate, ensure you have all the required documents, such as proof of identity and proof of residence. Having these documents readily available will streamline the application process.

Tip 2: Apply Online: The online application process through the iTax portal is convenient and efficient. It allows you to submit your application and upload the necessary documents from the comfort of your home or office.

Tip 3: Provide Accurate Information: Ensure that all the information you provide on your application is accurate and up-to-date. Any errors or discrepancies can delay the processing of your application.

Tip 4: Track Your Application Status: Once you have submitted your application, you can track its status online using the iTax portal. This allows you to monitor the progress of your application and identify any potential issues.

Tip 5: Keep a Copy of Your Certificate: Once you receive your KRA PIN Certificate, make a copy for your records. Keep the original in a safe place and present it whenever required for tax-related transactions.

Summary:

By following these tips, you can increase the efficiency and success of your "Kra Pin Certificate Application And" process. Remember to gather the necessary documents, apply online, provide accurate information, track your application status, and keep a copy of your certificate. These proactive measures will help you obtain your KRA PIN Certificate smoothly and promptly.

Conclusion

The "Kra Pin Certificate Application And" process plays a critical role in Kenya's tax administration system. Obtaining a KRA PIN Certificate is not only a legal requirement but also essential for various financial transactions and accessing essential services. The application process is generally straightforward and accessible, providing convenience to taxpayers.

By understanding the importance and benefits of a KRA PIN Certificate, taxpayers can take proactive steps to ensure a smooth and successful application process. Following the tips outlined in this article can help individuals and businesses obtain their certificates efficiently and contribute to the overall effectiveness of Kenya's tax system. The availability of online application and status tracking features further enhances the accessibility and transparency of the process.

Related Resources:

- Unlocking Claudette Colvins Untold Story Discoveries And Insights

- Unveiling The Secrets Of Sami Maleks Height Insights And Revelations

- Unveiling The Secrets A Journey Into Lauren Burchs Age Enigma

- Discover The Unstoppable Force Of Anthony Alabi In Professional Basketball

- Unveiling The Power Of Age Exploring Tolu Ballys Journey

Detail Author:

- Name : Duncan Harris V

- Username : amcdermott

- Email : johns.devonte@bechtelar.com

- Birthdate : 1985-06-05

- Address : 5942 Nolan Locks Suite 822 Willmsview, NE 52377-7186

- Phone : 470-874-0652

- Company : Stamm, Bednar and Leannon

- Job : Cartographer

- Bio : Enim deleniti a est reprehenderit et. Commodi sed laborum quos blanditiis. Blanditiis fugiat similique voluptas facere ut enim.

Socials

instagram:

- url : https://instagram.com/lonmraz

- username : lonmraz

- bio : Aliquam id repudiandae aspernatur ex sed quis dolorem. Similique non ex labore earum qui ut aut.

- followers : 5814

- following : 391

facebook:

- url : https://facebook.com/lonmraz

- username : lonmraz

- bio : Perspiciatis beatae officiis molestias asperiores ipsam.

- followers : 2708

- following : 1711

linkedin:

- url : https://linkedin.com/in/lon_dev

- username : lon_dev

- bio : Consequatur eum modi est fugiat animi.

- followers : 6945

- following : 1486

twitter:

- url : https://twitter.com/mrazl

- username : mrazl

- bio : Culpa sint doloremque suscipit. Est doloribus reiciendis veritatis tempora et amet ipsum. Debitis est voluptatem adipisci.

- followers : 5233

- following : 1357