Scott Patterson Net Worth refers to the financial value of all assets owned by actor Scott Patterson, including cash, equity, bonds, and real estate. A common way to gauge his financial success and status is to estimate the net worth of his assets.

Understanding Scott Patterson's net worth provides insights into his career trajectory, earning potential, and investment endeavors. Additionally, it can serve as a benchmark for other actors and individuals in the entertainment industry. A substantial net worth signifies financial stability and ensures access to resources that support personal and professional growth.

Historically, determining net worth was challenging, but the rise of financial transparency and celebrity culture has made it increasingly accessible. Today, estimates of Scott Patterson's net worth are widely available online, providing valuable information for financial analysts, investors, and fans.

- Unveiling The Hidden Gems Of Venetia Barretts Art

- Uncovering The Legacy And Impact Of Noted Journalist June Odonnell

- Rudy Hermann Guede Uncovering The Truth And Unraveling The Controversies

- Albert Pujols Unveiling The Secrets Of Baseballs Timeless Icon

- Unveiling The Secrets Discoveries And Insights Into Peso Pluma Siblings

Scott Patterson Net Worth

Understanding the essential aspects of Scott Patterson's net worth provides valuable insights into his financial success, career trajectory, and investment portfolio. Key aspects to consider include:

- Assets

- Income

- Investments

- Expenses

- Debt

- Taxes

- Inflation

- Financial planning

- Estate planning

These aspects are interconnected and influence the overall value of Scott Patterson's net worth. His income from acting, endorsements, and other ventures contributes to his assets, while his expenses, debt, and taxes reduce his net worth. Financial planning and estate planning are crucial for managing his wealth effectively and ensuring its preservation for the future.

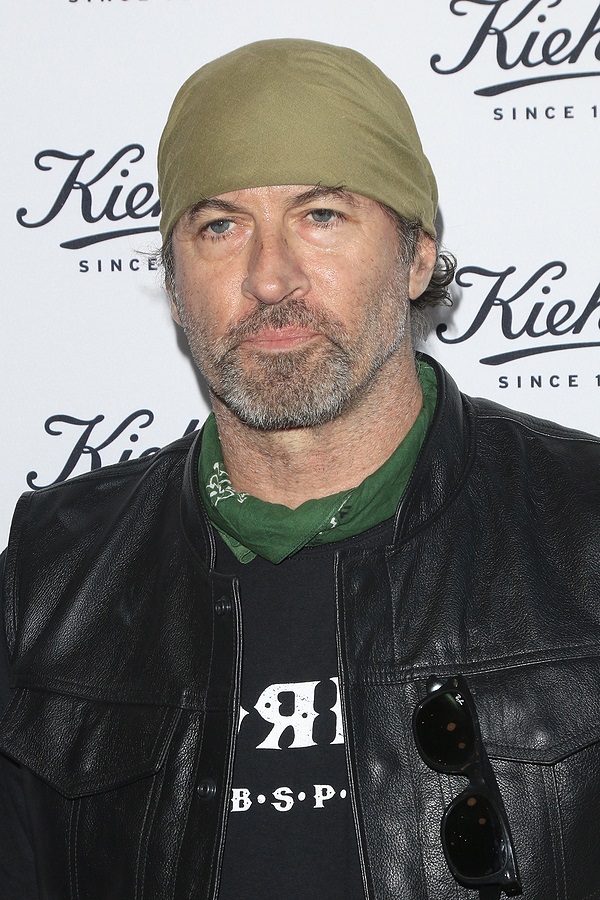

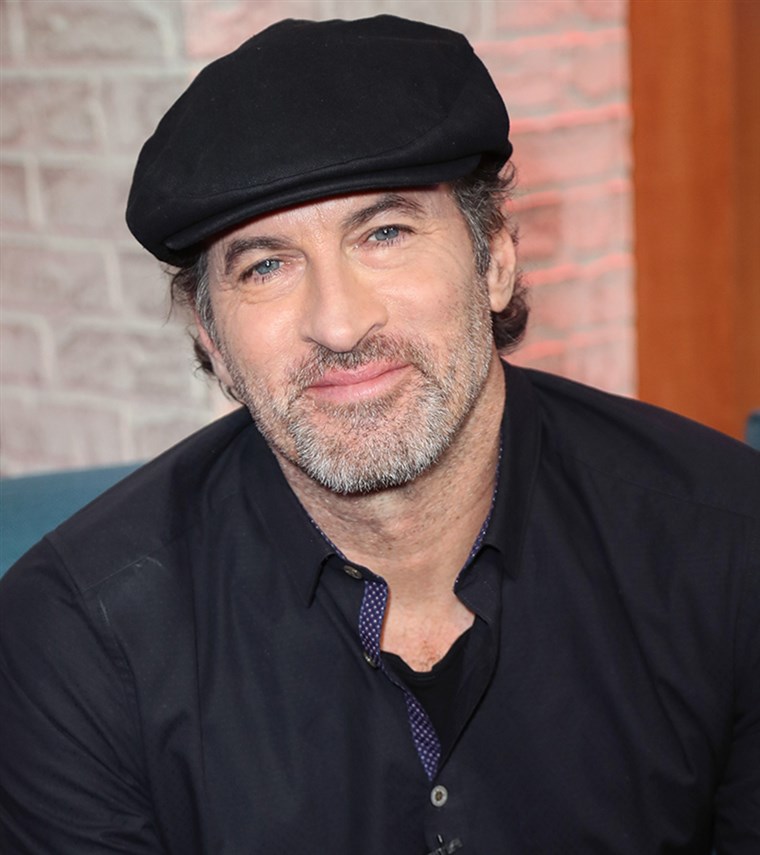

Personal Details and Bio Data of Scott Patterson:

- Uncover The Secrets Ice Cube Siblings Impact On Hiphop

- Unveiling The Multifaceted Talents Of Jermaine Jackson Jr A Journey Of Music Acting And Legacy

- Uncover The Untold Story Of Ellen Pompeos Real Family

- Unveiling The Marital Status Of Stephan Marley Discoveries And Insights

- Is Caribe Devine Married Uncover The Truths And Insights

Assets

Assets form the foundation of Scott Patterson's net worth, representing the resources and investments that contribute to his overall financial value. These assets can be categorized into various types, each with its unique characteristics and implications.

- Cash and Cash Equivalents

This includes currency, demand deposits, and other highly liquid assets that can be easily converted into cash. Cash and cash equivalents provide immediate access to funds for various purposes, such as meeting expenses or making investments.

- Real Estate

Patterson's real estate assets include residential properties, land, and commercial buildings. These investments represent a significant portion of his net worth and can provide rental income, capital appreciation, and diversification benefits.

- Stocks and Bonds

Patterson's investment portfolio likely includes stocks and bonds issued by various companies and governments. These investments offer the potential for capital growth and income generation through dividends and interest payments.

- Intellectual Property

As an actor, Patterson owns intellectual property rights to his creative works, such as royalties from film and television projects. These rights can provide a steady stream of income and contribute to the long-term value of his net worth.

Collectively, these assets represent the financial resources that Scott Patterson has accumulated throughout his career. Their value fluctuates based on market conditions, investment performance, and other factors, contributing to the dynamic nature of his net worth.

Income

Income plays a critical role in shaping Scott Patterson's net worth. As an actor, his income primarily stems from his involvement in film, television, and stage productions. Patterson's income directly contributes to his net worth by increasing the value of his assets and providing him with the means to cover his expenses and invest for the future.

Examples of Patterson's income include salaries for acting roles, royalties from, and earnings from endorsements and personal appearances. These sources of income are essential for Patterson to maintain and grow his net worth. Without a steady stream of income, it would be challenging for him to acquire and maintain valuable assets.

Understanding the connection between income and net worth is crucial for financial planning and wealth management. By focusing on increasing his income and managing his expenses effectively, Patterson can positively impact his net worth over time. This understanding empowers him to make informed decisions regarding his financial future and secure his long-term financial well-being.

Investments

Investments are a crucial aspect of Scott Patterson's net worth, representing his allocation of resources to generate future financial returns. Through strategic investments, Patterson aims to increase the value of his assets and secure his long-term financial well-being.

- Stocks

Patterson's investment portfolio likely includes stocks, representing ownership shares in various companies. By investing in stocks, he gains the potential for capital appreciation and dividend income, contributing to his net worth's growth.

- Real Estate

Real estate investments are another significant part of Patterson's portfolio. Purchasing properties, such as residential or commercial buildings, provides him with rental income, potential capital gains, and diversification benefits, further enhancing his net worth.

- Bonds

Bonds are fixed-income securities that Patterson may hold in his portfolio. These investments offer regular interest payments and return of principal upon maturity, providing a stable source of income and reducing overall portfolio risk.

- Venture Capital

Patterson may also invest in venture capital, which involves providing funding to early-stage or emerging businesses. While venture capital investments carry higher risk, they also have the potential for substantial returns, contributing to the growth of his net worth.

Collectively, these investments represent Patterson's strategic allocation of resources to generate financial returns and build long-term wealth. By diversifying his investments across various asset classes, he manages risk while maximizing the potential growth of his net worth.

Expenses

Expenses play a critical role in shaping Scott Patterson's net worth. They represent the costs associated with maintaining his lifestyle, managing his assets, and pursuing his financial goals.

- Living Expenses

These include basic necessities such as housing, food, transportation, and healthcare. Managing living expenses effectively is essential for preserving net worth and ensuring financial stability.

- Taxes

Patterson is obligated to pay various taxes, including income tax, property tax, and sales tax. Understanding tax implications and optimizing tax strategies is crucial for maximizing net worth.

- Investment Expenses

Investing involves costs such as brokerage fees, management fees, and transaction fees. These expenses reduce the overall return on investments and must be considered when evaluating net worth.

- Debt Repayment

If Patterson has any outstanding debts, such as a mortgage or personal loans, regular payments are required to reduce the principal and interest. Debt repayment affects net worth by reducing available assets.

Understanding the various types of expenses and their impact on net worth is essential for Scott Patterson's financial well-being. By managing expenses diligently, he can preserve his wealth, optimize investment returns, and achieve long-term financial success.

Debt

Debt is a crucial aspect of Scott Patterson's net worth, representing liabilities that reduce the overall value of his assets. Understanding the types and implications of debt is essential for assessing his financial health and planning for the future.

- Mortgages

Mortgages are loans secured by real estate, typically used to finance the purchase of a home. Patterson may have a mortgage on his primary residence or investment properties, which would represent a significant portion of his debt.

- Personal Loans

Personal loans are unsecured loans used for various purposes, such as consolidating debt, financing major purchases, or covering unexpected expenses. Patterson may have personal loans outstanding, depending on his financial situation and spending habits.

- Business Loans

Business loans are used to finance business operations, such as expanding inventory, purchasing equipment, or covering operating expenses. If Patterson has business ventures, he may have outstanding business loans that contribute to his overall debt.

- Credit Card Debt

Credit card debt arises from unpaid balances on credit cards. High credit card debt can negatively impact credit scores and increase interest payments, potentially affecting Patterson's financial stability.

The presence of debt can influence Patterson's investment decisions, spending habits, and overall financial well-being. Managing debt effectively, including timely payments and strategic debt consolidation, is crucial for preserving his net worth and achieving long-term financial success.

Taxes

Taxes are an integral aspect of Scott Patterson's net worth, representing mandatory contributions to government entities that impact his overall financial standing. Understanding the various types of taxes and their implications is crucial for effective financial planning and wealth management.

- Income Tax

Income tax is levied on Patterson's earnings from acting, investments, and other sources. The amount of income tax he owes is determined by his taxable income and applicable tax rates. Paying income tax reduces his disposable income and affects his net worth.

- Property Tax

Property tax is an annual charge levied on real estate owned by Patterson. The amount of property tax is based on the assessed value of the property and local tax rates. Property taxes reduce his net worth by decreasing the value of his real estate assets.

- Sales Tax

Sales tax is a consumption tax levied on goods and services purchased by Patterson. The amount of sales tax varies depending on the jurisdiction and the type of goods or services purchased. Sales tax reduces his disposable income and indirectly impacts his net worth.

- Capital Gains Tax

Capital gains tax is levied on profits from the sale of assets, such as stocks or real estate. Patterson may incur capital gains tax if he sells investments or properties for a profit. Capital gains tax reduces the net proceeds from asset sales, affecting his net worth.

Overall, taxes play a significant role in shaping Scott Patterson's net worth. Understanding tax implications and optimizing tax strategies are essential for maximizing his wealth and achieving long-term financial success.

Inflation

Inflation plays a significant role in shaping Scott Patterson's net worth. It erodes the purchasing power of money over time, affecting the value of his assets and the cost of his expenses. Understanding the impact of inflation is crucial for informed financial planning and wealth management.

- Consumer Price Index (CPI)

The CPI measures changes in the prices of goods and services purchased by consumers. A rising CPI indicates inflation, reducing the value of Scott Patterson's cash and cash equivalents.

- Purchasing Power

Inflation reduces the purchasing power of Scott Patterson's income. As prices rise, his income can buy fewer goods and services, potentially impacting his lifestyle and financial goals.

- Investment Returns

Inflation can erode the real returns on Scott Patterson's investments. If the rate of inflation exceeds the return on his investments, the value of his investments will decline in real terms.

- Debt Repayment

Inflation can make it easier to repay debt. As the value of money decreases, the real value of outstanding debt also decreases. This can benefit Scott Patterson if he has outstanding loans.

Inflation is a complex economic phenomenon that can have significant implications for Scott Patterson's net worth. By understanding the different facets of inflation and its potential impact, he can make informed decisions to preserve and grow his wealth over time.

Financial planning

Financial planning plays a vital role in the management and growth of Scott Patterson's net worth. It encompasses a range of strategies and considerations that aim to preserve, increase, and distribute his financial resources effectively.

- Investment Management

Developing a diversified investment portfolio that aligns with his risk tolerance and financial goals. Patterson may invest in a mix of stocks, bonds, real estate, and alternative assets to maximize returns while minimizing risk.

- Tax Planning

Optimizing tax strategies to reduce tax liabilities and maximize after-tax income. Patterson may utilize tax-advantaged accounts, such as retirement plans and charitable trusts, to minimize the impact of taxes on his net worth.

- Retirement Planning

Ensuring financial security during retirement years. Patterson may contribute to retirement accounts, such as IRAs and 401(k)s, and explore additional income sources to supplement his retirement income.

- Estate Planning

Preserving and distributing his assets according to his wishes after his death. Patterson may create a will or trust to ensure the orderly transfer of his wealth and minimize estate taxes.

Effective financial planning is crucial for Scott Patterson to achieve long-term financial success and preserve his net worth. By adopting a comprehensive approach that considers various aspects of financial management, he can make informed decisions, mitigate risks, and maximize the growth of his wealth.

Estate planning

Estate planning is a crucial aspect of managing Scott Patterson's net worth and ensuring the orderly transfer of his wealth after his death. It encompasses various legal and financial strategies designed to preserve, distribute, and minimize taxes on his assets.

- Will

A legal document that outlines Patterson's wishes for the distribution of his assets after his death. It allows him to specify beneficiaries, appoint an executor, and establish guardians for minor children.

- Trust

A legal entity that holds and manages assets for the benefit of designated beneficiaries. Trusts can be used to avoid probate, minimize taxes, and provide for specific needs, such as supporting a disabled child.

- Power of attorney

A legal document that grants another person the authority to make financial and healthcare decisions on Patterson's behalf in the event he becomes incapacitated.

- Advance directive

A document that outlines Patterson's preferences for medical treatment in the event he is unable to communicate his wishes. It can include instructions on life support, pain management, and end-of-life care.

By implementing a comprehensive estate plan, Scott Patterson can ensure that his assets are distributed according to his wishes, minimize the tax burden on his beneficiaries, and provide for their future financial security. Estate planning is an essential component of his overall financial strategy, complementing his efforts to preserve and grow his net worth.

In conclusion, Scott Patterson's net worth is a testament to his successful acting career, savvy investments, and prudent financial planning. His wealth encompasses a diverse portfolio of assets, including real estate, stocks, bonds, and intellectual property rights. By understanding the various components of his net worth, we gain insights into his financial acumen and the strategies he has employed to preserve and grow his wealth.

Two key takeaways emerge from this exploration. First, a diversified investment portfolio is essential for mitigating risk and maximizing returns. Patterson's investments span various asset classes, allowing him to balance risk and capture growth opportunities. Second, effective financial planning is crucial for long-term wealth management. Patterson's estate plan ensures the orderly transfer of his assets according to his wishes and minimizes the tax burden on his beneficiaries.

Related Resources:

- Unveiling The Multifaceted Diane Farr Discoveries And Insights

- Unveiling The Secrets Of Gothams Finest Allison Foster Revealed

- Unlocking The Legacy Of Nichelle Nichols Trailblazer Icon And Inspiration

- Unveiling The Secrets Kevin And Drekas Journey To Success And Love

- Unveiling The Untold Story Alvin Martin And Whoopi Goldbergs Impact On Love Race And Identity

Detail Author:

- Name : Miss Destany McGlynn

- Username : drake48

- Email : adalberto81@hotmail.com

- Birthdate : 1992-09-20

- Address : 4267 Mason Court Apt. 331 South Megane, WI 20142

- Phone : 518-799-6374

- Company : Jaskolski, Fahey and Hagenes

- Job : Locker Room Attendant

- Bio : Voluptatem fuga vel error accusantium perspiciatis voluptatem. Qui consequuntur iste quas et. Voluptate et sapiente deserunt facilis.

Socials

facebook:

- url : https://facebook.com/larue_official

- username : larue_official

- bio : Ratione sint et perspiciatis similique odit ut et.

- followers : 4607

- following : 446

tiktok:

- url : https://tiktok.com/@larue_xx

- username : larue_xx

- bio : Fugiat molestiae sunt animi aut. Porro molestiae molestias consequatur nostrum.

- followers : 1995

- following : 2427

instagram:

- url : https://instagram.com/lbrekke

- username : lbrekke

- bio : Magnam voluptatum dolores dolore minima voluptas. Eligendi dolore velit minus aut.

- followers : 5300

- following : 1440