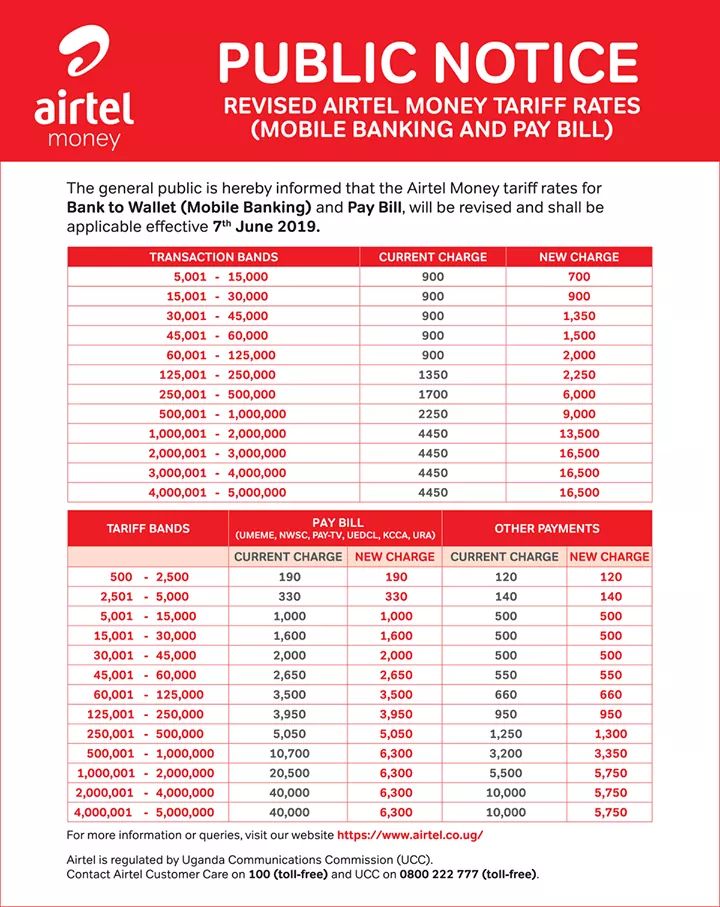

Airtel Money withdrawal charges refer to the fees levied by Airtel, a telecommunications company, for withdrawing funds from Airtel Money, a mobile money service. These charges vary depending on the withdrawal method used, such as ATM withdrawal, agent withdrawal, or bank transfer.

Understanding Airtel Money withdrawal charges is important for users to manage their financial transactions effectively. The charges can impact the overall cost of using the service and influence users' decisions regarding withdrawal methods. Additionally, being aware of the charges helps users avoid unexpected expenses and plan their withdrawals accordingly.

The specific charges for Airtel Money withdrawal may vary based on factors such as the user's location, the amount being withdrawn, and the withdrawal channel selected. It is recommended for users to consult Airtel's official website or contact customer care for the most up-to-date information on withdrawal charges.

- Nick Wolfhard Unlocking The Secrets Of The Young Hollywood Star

- Unveiling The Visionary Vince Mcmahon Srs Unforgettable Legacy In Wrestling

- Unveiling The Truth Kevin Gates Marital Status Revealed

- Unveiling The Real Story Behind Olivia Casta Real Name

- Unveil The Enigmatic Grace Jones Discoveries And Untold Insights

Airtel Money Withdrawal Charges

Airtel Money withdrawal charges are fees levied by Airtel for withdrawing funds from its mobile money service. Understanding these charges is crucial for effective financial management and to avoid unexpected expenses.

- Amount: Withdrawal charges vary based on the amount being withdrawn.

- Method: Charges differ depending on the withdrawal method (ATM, agent, bank transfer).

- Location: Charges may vary based on the user's location.

- Frequency: Some charges may apply only to a certain number of withdrawals within a period.

- Threshold: Charges may be waived or reduced for withdrawals above a certain amount.

- Taxes: Withdrawal charges may be subject to applicable taxes.

- Convenience: The convenience of the withdrawal method should be weighed against the charges.

- Alternatives: Exploring alternative withdrawal methods with lower charges may be beneficial.

In conclusion, Airtel Money withdrawal charges encompass various aspects that impact users' financial transactions. By considering the amount, method, location, frequency, threshold, taxes, convenience, and alternatives, users can make informed decisions about their withdrawals and optimize their use of the service.

Amount

The amount being withdrawn is a primary factor that influences Airtel Money withdrawal charges. As the withdrawal amount increases, the charges tend to increase as well. This is because Airtel incurs higher transaction costs for larger withdrawals, including network fees, processing fees, and regulatory compliance expenses.

- Unveiling Paul Redford Beyond The Silver Screen

- Unveiling The Inspiring Journey Of Demar Derozans Spouse

- Unveiling Leslie Whitaker The Accomplished Journalist And Wife Of Bill Whitaker

- Unlocking The Secrets Of Stephen Marleys Marital Status

- Unlocking The Secrets Of Olivia Castas Enduring Love

- Withdrawal Tiers: Airtel may establish different withdrawal tiers with corresponding charges. For instance, withdrawals below a certain amount may incur a flat fee, while withdrawals above that amount may be charged a percentage-based fee.

- Transaction Volume: High-volume withdrawals may qualify for discounted charges or reduced fees. Airtel may offer preferential rates to customers who frequently withdraw large amounts, encouraging loyalty and repeat business.

- Risk Assessment: Airtel considers the risk associated with the withdrawal amount. Larger withdrawals may trigger additional security measures and verification procedures, which can result in higher charges to cover the costs of these precautions.

- Market Dynamics: Competitive market conditions can influence Airtel's withdrawal charges. Airtel may adjust charges based on industry trends, competitor pricing, and overall market demand for mobile money services.

In summary, the amount being withdrawn plays a crucial role in determining Airtel Money withdrawal charges. By understanding the relationship between withdrawal amount and charges, users can optimize their transactions and minimize expenses.

Method

The withdrawal method is a significant factor influencing Airtel Money withdrawal charges. Different methods involve varying levels of operational costs, security measures, and transaction fees, which are reflected in the charges levied by Airtel.

1. ATM Withdrawal: Withdrawing cash from an ATM incurs higher charges compared to other methods. This is because banks and ATM operators charge Airtel a fee for each ATM transaction. Additionally, Airtel may impose a separate ATM withdrawal fee to cover its own operating costs and maintenance expenses.

2. Agent Withdrawal: Withdrawing funds through an Airtel Money agent typically involves lower charges than ATM withdrawals. Agents act as intermediaries between Airtel and the customer, facilitating cash withdrawals and deposits. Airtel charges a commission to agents for each transaction, which is often passed on to the customer as a withdrawal fee.

3. Bank Transfer: Transferring money from Airtel Money to a bank account usually incurs the lowest charges among the available withdrawal methods. This is because bank transfers are processed electronically, eliminating the need for physical cash handling and reducing operational costs for Airtel. However, the customer may incur charges from their bank for receiving the transfer.

Understanding the charges associated with different withdrawal methods allows users to make informed decisions and choose the most cost-effective option based on their needs and circumstances. By considering the charges, users can optimize their Airtel Money usage and minimize unnecessary expenses.

Location

The location of the user can influence Airtel Money withdrawal charges due to several factors:

- Regulatory Environment: Different countries and regions have varying regulatory frameworks for mobile money services, including Airtel Money. These regulations may impose specific requirements or fees on transactions, which can be passed on to the customer as withdrawal charges.

- Economic Conditions: The economic conditions in a particular location can affect the costs associated with providing Airtel Money services. Factors such as inflation, exchange rates, and local infrastructure can impact the charges levied by Airtel.

- Market Competition: The level of competition in the mobile money market can influence withdrawal charges. In areas with multiple mobile money providers, Airtel may adjust charges to remain competitive and attract customers.

- Agent Network: The availability and density of Airtel Money agents in a location can affect withdrawal charges. In areas with a wider agent network, Airtel may offer lower charges to encourage agent transactions and increase accessibility.

Understanding the impact of location on Airtel Money withdrawal charges is crucial for users to make informed decisions about their transactions. By considering the factors mentioned above, users can anticipate potential variations in charges based on their location and plan their withdrawals accordingly.

Frequency

The frequency of Airtel Money withdrawals can impact the applicable charges. Some charges may only apply to a certain number of withdrawals within a specified period, such as daily, weekly, or monthly. Understanding this frequency component is crucial for optimizing Airtel Money usage and avoiding unexpected charges.

Airtel may impose tiered charges based on the number of withdrawals within a period. For instance, the first few withdrawals may be free or charged at a lower rate, while subsequent withdrawals within the same period may incur higher charges. This structure encourages responsible usage and discourages excessive withdrawals, which can strain Airtel's operational capacity.

For users who frequently make Airtel Money withdrawals, it is advisable to monitor their withdrawal frequency and plan accordingly. Exceeding the specified number of free or low-cost withdrawals can result in additional charges, increasing the overall cost of using the service.

By understanding the frequency component of Airtel Money withdrawal charges, users can make informed decisions about their withdrawals, avoid unnecessary expenses, and maximize the benefits of the service.

Threshold

The threshold concept plays a significant role in shaping Airtel Money withdrawal charges. Airtel may establish a minimum withdrawal amount threshold, below which standard withdrawal charges apply. However, when withdrawals exceed this threshold, charges may be waived or significantly reduced.

This threshold mechanism serves several purposes. Firstly, it encourages users to make larger withdrawals less frequently, reducing the overall number of transactions processed by Airtel. This, in turn, helps Airtel optimize its operational costs and maintain a sustainable fee structure.

Secondly, the threshold incentivizes users to consolidate their withdrawals into larger amounts. By accumulating funds and withdrawing them once they exceed the threshold, users can save on withdrawal charges over time. This encourages responsible financial management and reduces unnecessary expenses.

Understanding the threshold component of Airtel Money withdrawal charges is crucial for users to optimize their transactions. By planning withdrawals strategically and accumulating funds to exceed the threshold, users can minimize charges and maximize the value of the service.

Taxes

The connection between "Taxes: Withdrawal charges may be subject to applicable taxes" and "airtel money withdrawal charges" signifies the potential impact of taxation on the overall cost of using Airtel Money withdrawal services.

- Value Added Tax (VAT): In many jurisdictions, VAT is levied on the provision of financial services, including mobile money transactions. Airtel Money withdrawal charges may be subject to VAT, increasing the overall cost of withdrawal for users.

- Withholding Tax: Some countries impose withholding tax on income earned from investments or financial transactions. Airtel Money withdrawal charges may be subject to withholding tax if the funds being withdrawn are considered taxable income.

- Transaction Tax: Certain governments impose a tax on each financial transaction, regardless of its nature. Airtel Money withdrawal charges may be subject to transaction tax, adding an additional layer of cost to the withdrawal process.

Understanding the potential tax implications of Airtel Money withdrawal charges is crucial for users to accurately assess the total cost of using the service. By factoring in applicable taxes, users can make informed decisions about their withdrawals and manage their finances effectively.

Convenience

When considering Airtel Money withdrawal charges, the convenience of the withdrawal method is a crucial factor to consider. Different withdrawal methods offer varying levels of convenience, each with its own associated charges.

For instance, withdrawing cash from an ATM may incur higher charges compared to withdrawing through an Airtel Money agent. However, ATMs offer the convenience of 24/7 access and widespread availability. On the other hand, agent withdrawals may have lower charges but may be limited by the agent's operating hours and location.

Understanding the convenience factor helps users make informed decisions about their withdrawals. By weighing the convenience of each method against the associated charges, users can choose the option that best suits their needs and preferences.

Alternatives

Considering alternative withdrawal methods with lower charges can be a prudent financial strategy in relation to Airtel Money withdrawal charges. Exploring such alternatives empowers users to make informed decisions and optimize their money management practices.

For example, if Airtel Money withdrawal charges are relatively high at a particular ATM location, users can explore nearby ATMs operated by other banks or financial institutions that may offer lower charges. Additionally, utilizing Airtel Money agents for withdrawals can often result in lower charges compared to ATM withdrawals, especially for smaller amounts.

By understanding the availability of alternative withdrawal methods and their associated charges, users can proactively seek out options that align with their financial needs and goals. This understanding empowers them to minimize unnecessary expenses and maximize the value of their Airtel Money accounts.

FAQs on Airtel Money Withdrawal Charges

This section addresses frequently asked questions regarding Airtel Money withdrawal charges, providing clear and concise answers to common concerns or misconceptions.

Question 1: What factors influence Airtel Money withdrawal charges?

Airtel Money withdrawal charges are primarily determined by the withdrawal amount, method, and location. Higher withdrawal amounts, certain withdrawal methods (such as ATM withdrawals), and specific locations may incur higher charges.

Question 2: Are there any charges for Airtel Money withdrawals below a certain amount?

Yes, Airtel may impose a flat fee or a percentage-based charge for withdrawals below a specified threshold amount. This threshold varies depending on the country or region.

Question 3: How can I minimize Airtel Money withdrawal charges?

To minimize charges, consider withdrawing larger amounts less frequently, opting for lower-cost withdrawal methods (such as agent withdrawals), and exploring alternative withdrawal options with competitive charges.

Question 4: Are Airtel Money withdrawal charges subject to taxes?

Yes, Airtel Money withdrawal charges may be subject to applicable taxes, such as value-added tax (VAT) or withholding tax, depending on the jurisdiction.

Question 5: Can I negotiate Airtel Money withdrawal charges with Airtel?

Typically, Airtel Money withdrawal charges are fixed and non-negotiable. However, certain high-volume customers or businesses may be eligible for customized pricing or reduced charges upon request.

Question 6: How can I stay updated on changes to Airtel Money withdrawal charges?

Airtel typically communicates any changes to withdrawal charges through official announcements, SMS notifications, or updates on their website and mobile app. Regularly checking these sources ensures you have the most current information.

By understanding these FAQs, you can make informed decisions about your Airtel Money withdrawals, optimize your financial transactions, and minimize unnecessary charges.

Transition to the next article section:

Explore additional insights on Airtel Money withdrawal charges and related topics in the following sections.

Tips on Airtel Money Withdrawal Charges

Understanding Airtel Money withdrawal charges is crucial for optimizing your financial transactions. Here are some valuable tips to minimize charges and maximize the value of your Airtel Money account:

Tip 1: Withdraw Larger Amounts Less Frequently

Airtel Money charges are often tiered, with higher charges for smaller withdrawals. By accumulating funds and withdrawing larger amounts less frequently, you can reduce the overall number of withdrawals and save on charges.

Tip 2: Opt for Lower-Cost Withdrawal Methods

Different withdrawal methods have varying charges. Consider using Airtel Money agents for withdrawals, as they typically offer lower charges compared to ATM withdrawals. Additionally, explore alternative withdrawal options such as bank transfers, which may have competitive charges.

Tip 3: Withdraw Within Threshold Limits

Some Airtel Money operators set withdrawal threshold amounts, below which standard charges apply. Exceeding the threshold may result in lower or no charges. Plan your withdrawals strategically to take advantage of these thresholds.

Tip 4: Be Aware of Peak Charges

Airtel Money withdrawal charges may vary depending on the time of day or day of the week. Avoid making withdrawals during peak times, such as weekends or evenings, when charges may be higher.

Tip 5: Use Airtel Money Promotional Offers

Airtel may offer promotional offers or discounts on withdrawal charges from time to time. Take advantage of these offers to save on your withdrawal fees.

By following these tips, you can effectively manage Airtel Money withdrawal charges, optimize your financial transactions, and get the most value out of your Airtel Money account.

Summary:

Understanding Airtel Money withdrawal charges is essential for prudent financial management. By implementing these tips, you can minimize charges, maximize the value of your withdrawals, and enjoy the convenience of Airtel Money services.

Conclusion

Airtel Money withdrawal charges are an important aspect to consider when using Airtel's mobile money service. Understanding these charges and the factors that influence them empowers users to optimize their financial transactions and minimize unnecessary expenses.

This article has explored the various aspects of Airtel Money withdrawal charges, including the impact of withdrawal amount, method, location, frequency, threshold, and taxes. It has also provided valuable tips to help users manage their charges effectively.

By leveraging the insights and tips provided in this article, users can make informed decisions about their Airtel Money withdrawals, reduce associated charges, and enjoy a seamless mobile money experience.

Related Resources:

Detail Author:

- Name : Anderson Sipes

- Username : reyes.moen

- Email : cary.bogan@mcclure.com

- Birthdate : 1983-04-22

- Address : 8254 Greenholt Plain Apt. 567 South Nattown, CT 28012

- Phone : 865-767-2464

- Company : Lindgren-Macejkovic

- Job : Forging Machine Setter

- Bio : Sapiente veritatis sunt vitae recusandae asperiores corrupti tempore. Deserunt blanditiis sint ea eos dolorem. Voluptatem nesciunt quasi quos autem ea aliquid sint nemo.

Socials

instagram:

- url : https://instagram.com/daughertyv

- username : daughertyv

- bio : Quos molestias non vitae et voluptate assumenda. Maiores optio natus temporibus quis.

- followers : 327

- following : 671

tiktok:

- url : https://tiktok.com/@vicky_daugherty

- username : vicky_daugherty

- bio : Nobis qui pariatur reiciendis pariatur dolores aut.

- followers : 2720

- following : 2388

facebook:

- url : https://facebook.com/vicky5829

- username : vicky5829

- bio : Sunt velit omnis aliquam enim maxime dicta in.

- followers : 3869

- following : 2618

twitter:

- url : https://twitter.com/vicky.daugherty

- username : vicky.daugherty

- bio : Velit ipsa eos quae ullam earum sapiente. Reprehenderit quia est accusamus et totam ut sit. Repudiandae non voluptatibus iste occaecati facilis animi.

- followers : 5000

- following : 1892

linkedin:

- url : https://linkedin.com/in/vickydaugherty

- username : vickydaugherty

- bio : Dicta est ipsam nam vel eos unde.

- followers : 6924

- following : 1869