Airtel Money Uganda withdrawal charges refer to the fees levied by Airtel Uganda for withdrawing money from an Airtel Money account.

When withdrawing money from an Airtel Money account, the charges vary depending on the withdrawal method used and the amount being withdrawn. For instance, withdrawing money from an Airtel Money agent incurs a fee of UGX 500 for withdrawals of up to UGX 50,000, and UGX 1,000 for withdrawals above UGX 50,000.

Withdrawing money from an ATM using an Airtel Money card attracts a fee of UGX 2,000 per transaction, while withdrawing money from a bank account via Airtel Money incurs a fee of UGX 1,000 per transaction.

- Unveiling The Enigmatic Molly Hickford Discoveries And Insights

- Unlocking The Secrets Of Gene Simmons Age Discoveries And Insights

- Unveiling The Legacy And Impact Of Lori Petty In Point Break

- Unveiling The Brilliance Of Johvannie Jackson Discoveries And Insights Await

- Unveiling Leslie Whitaker The Accomplished Journalist And Wife Of Bill Whitaker

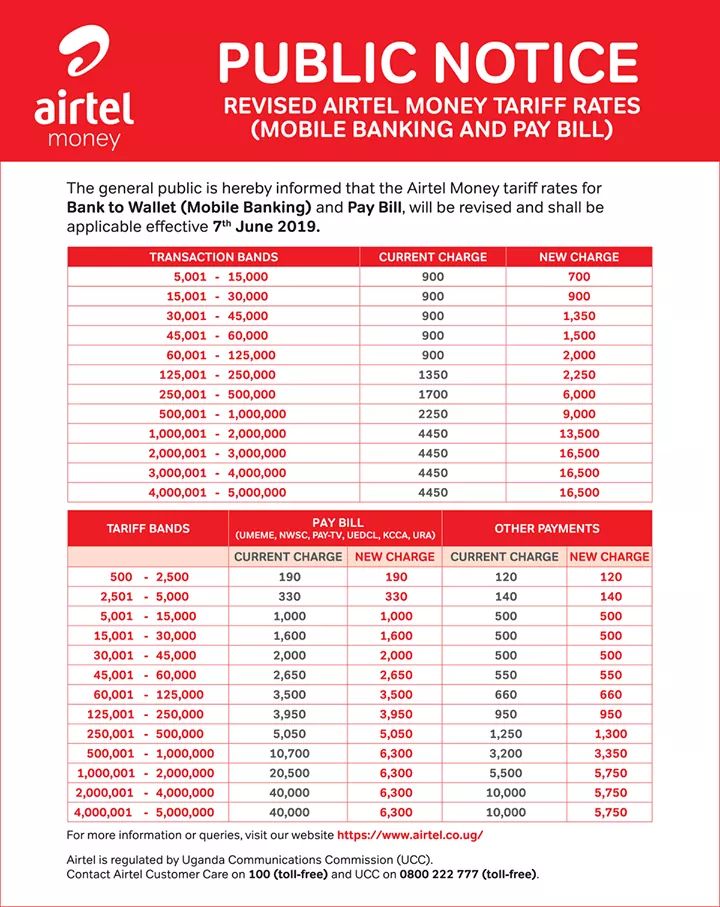

It's important to note that these charges are subject to change, and customers are advised to confirm the prevailing charges with Airtel Uganda before making a withdrawal.

Airtel Money Uganda Withdrawal Charges

Airtel Money Uganda withdrawal charges are the fees levied by Airtel Uganda for withdrawing money from an Airtel Money account. These charges vary depending on the withdrawal method used and the amount being withdrawn.

- Withdrawal method: Airtel Money agents, ATMs, and bank accounts.

- Withdrawal amount: The charges vary depending on the amount being withdrawn.

- Transaction fee: A fee is charged for each withdrawal transaction.

- Minimum balance: A minimum balance may be required to avoid withdrawal charges.

- Daily withdrawal limit: There may be a daily limit on the amount of money that can be withdrawn.

- Monthly withdrawal limit: There may be a monthly limit on the amount of money that can be withdrawn.

- Taxes: Withdrawal charges may be subject to taxes.

- Convenience fee: Some withdrawal methods may attract a convenience fee.

- Currency conversion fee: If withdrawing money in a different currency, a currency conversion fee may apply.

It is important to note that these charges are subject to change, and customers are advised to confirm the prevailing charges with Airtel Uganda before making a withdrawal.

- Dive Into The World Of Ellen Pompeos Siblings Uncover Hidden Stories And Surprising Connections

- Unveiling The Age Of Amity From The Owl House A Journey Of Growth And Discovery

- Unlocking Gender Equality Unveiling The Secrets Of The Rajek Model

- Uncovering The Legacy And Impact Of Noted Journalist June Odonnell

- Unveiling The Multifaceted World Of Duff Badgley Insights And Discoveries

Withdrawal method

The withdrawal method used has a significant impact on the charges incurred when withdrawing money from an Airtel Money account in Uganda. Here's a breakdown of the different withdrawal methods and their associated charges:

- Airtel Money agents: Withdrawing money from an Airtel Money agent incurs a fee of UGX 500 for withdrawals of up to UGX 50,000, and UGX 1,000 for withdrawals above UGX 50,000.

- ATMs: Withdrawing money from an ATM using an Airtel Money card attracts a fee of UGX 2,000 per transaction.

- Bank accounts: Withdrawing money from a bank account via Airtel Money incurs a fee of UGX 1,000 per transaction.

When choosing a withdrawal method, it is important to consider the convenience and cost of each option. Airtel Money agents are widely available, but they may charge higher fees than other methods. ATMs are convenient, but they may not be available in all locations. Bank transfers are a secure and convenient way to withdraw money, but they may take longer to process and may incur additional fees from the bank.

Withdrawal amount

The withdrawal amount is one of the key factors that determine the charges incurred when withdrawing money from an Airtel Money account in Uganda. Airtel Uganda has a tiered pricing structure for withdrawals, with higher charges for larger withdrawal amounts.

- Tier 1: Withdrawals of up to UGX 50,000 incur a fee of UGX 500.

- Tier 2: Withdrawals above UGX 50,000 incur a fee of UGX 1,000.

This tiered pricing structure is designed to encourage customers to make larger withdrawals less frequently, which reduces Airtel Uganda's operating costs. It is important for customers to be aware of this pricing structure so that they can plan their withdrawals accordingly.

In addition to the tiered pricing structure, Airtel Uganda also offers a number of other withdrawal options that may incur different charges. For example, withdrawing money from an Airtel Money agent may incur a higher fee than withdrawing money from an ATM. Customers should compare the charges for different withdrawal options before choosing the one that is most convenient and cost-effective for them.

Transaction fee

The transaction fee is a key component of Airtel Money Uganda withdrawal charges. It is a fee that is charged for each withdrawal transaction, regardless of the amount being withdrawn or the withdrawal method used. The transaction fee is designed to cover the costs of processing the withdrawal transaction, including the cost of maintaining the Airtel Money platform, the cost of fraud prevention, and the cost of customer support.

The transaction fee is an important source of revenue for Airtel Uganda. It helps to offset the costs of providing Airtel Money services and allows Airtel Uganda to continue to invest in the platform and improve its services. The transaction fee also helps to ensure that Airtel Money remains a sustainable business.

Customers should be aware of the transaction fee before making a withdrawal. The transaction fee is typically displayed on the withdrawal screen before the transaction is completed. Customers can also check the Airtel Money website or contact Airtel Uganda customer support to find out the transaction fee for a particular withdrawal method.

Minimum balance

Maintaining a minimum balance in your Airtel Money Uganda account can help you avoid withdrawal charges. Airtel Uganda, like many other financial institutions, charges a fee for withdrawals below a certain amount. This fee is designed to encourage customers to make larger, less frequent withdrawals, which reduces Airtel Uganda's operating costs.

The minimum balance required to avoid withdrawal charges varies depending on the withdrawal method used. For example, there is no minimum balance required to withdraw money from an Airtel Money agent, but there is a minimum balance of UGX 10,000 required to withdraw money from an ATM.

Customers who frequently make small withdrawals may find it beneficial to maintain a minimum balance in their Airtel Money Uganda account. This will help them avoid withdrawal charges and save money in the long run.

Here are some tips for maintaining a minimum balance in your Airtel Money Uganda account:

- Set up a recurring deposit from your bank account to your Airtel Money account.

- Use Airtel Money to receive your salary or other payments.

- Make larger, less frequent withdrawals.

- Avoid making small withdrawals from ATMs.

By following these tips, you can maintain a minimum balance in your Airtel Money Uganda account and avoid withdrawal charges.

Daily withdrawal limit

The daily withdrawal limit is a key aspect of airtel money uganda withdraw charges. It refers to the maximum amount of money that a customer can withdraw from their Airtel Money account in a single day. This limit is set by Airtel Uganda to manage its risk and prevent fraud.

- Customer protection: The daily withdrawal limit helps to protect customers from fraud. If a customer's account is compromised, the thief will only be able to withdraw up to the daily limit. This can help to minimize the customer's losses.

- Risk management: The daily withdrawal limit also helps Airtel Uganda to manage its risk. By limiting the amount of money that a customer can withdraw in a single day, Airtel Uganda can reduce its exposure to losses in the event of a fraud or security breach.

- Convenience: The daily withdrawal limit can also be a convenience for customers. By knowing the daily limit, customers can plan their withdrawals accordingly and avoid the disappointment of trying to withdraw more money than they are allowed.

The daily withdrawal limit for Airtel Money Uganda is UGX 1,000,000. This limit applies to all withdrawal methods, including withdrawals from Airtel Money agents, ATMs, and banks. Customers who need to withdraw more than UGX 1,000,000 in a single day can contact Airtel Uganda customer support to request an increase in their limit.

Monthly withdrawal limit

The monthly withdrawal limit is directly related to airtel money uganda withdraw charges because it sets a limit on the total amount of money that a customer can withdraw from their Airtel Money account in a single month. This limit is in addition to the daily withdrawal limit, and it helps to protect customers from fraud and manage Airtel Uganda's risk.

- Customer protection: The monthly withdrawal limit helps to protect customers from fraud. If a customer's account is compromised, the thief will only be able to withdraw up to the monthly limit. This can help to minimize the customer's losses.

- Risk management: The monthly withdrawal limit also helps Airtel Uganda to manage its risk. By limiting the amount of money that a customer can withdraw in a single month, Airtel Uganda can reduce its exposure to losses in the event of a fraud or security breach.

- Convenience: The monthly withdrawal limit can also be a convenience for customers. By knowing the monthly limit, customers can plan their withdrawals accordingly and avoid the disappointment of trying to withdraw more money than they are allowed.

The monthly withdrawal limit for Airtel Money Uganda is UGX 5,000,000. This limit applies to all withdrawal methods, including withdrawals from Airtel Money agents, ATMs, and banks. Customers who need to withdraw more than UGX 5,000,000 in a single month can contact Airtel Uganda customer support to request an increase in their limit.

Taxes

Taxes are an important component of airtel money uganda withdraw charges. In Uganda, withdrawal charges are subject to a 10% withholding tax. This means that for every UGX 1,000 that you withdraw from your Airtel Money account, UGX 100 will be deducted as withholding tax.

The withholding tax on withdrawal charges is a way for the Ugandan government to collect revenue. This revenue is used to fund public services such as education, healthcare, and infrastructure. By paying withholding tax on withdrawal charges, Airtel Money users are contributing to the development of their country.

It is important to be aware of the withholding tax on withdrawal charges before making a withdrawal. This will help you to avoid any surprises when you see the amount of money that has been deducted from your account.

Convenience fee

A convenience fee is a charge that is levied by some withdrawal methods in addition to the standard withdrawal charge. This fee is typically charged to cover the cost of providing the withdrawal service, such as the cost of operating an ATM or the cost of processing a withdrawal at an agent location.

In the case of Airtel Money Uganda, a convenience fee is charged for withdrawals made at agent locations. The convenience fee is UGX 500 for withdrawals of up to UGX 50,000, and UGX 1,000 for withdrawals above UGX 50,000.

The convenience fee is an important component of Airtel Money Uganda withdrawal charges because it helps to cover the cost of providing the withdrawal service. Without the convenience fee, Airtel Uganda would have to charge a higher standard withdrawal charge in order to cover its costs.

Customers should be aware of the convenience fee before making a withdrawal. The convenience fee is typically displayed on the withdrawal screen before the transaction is completed. Customers can also check the Airtel Money website or contact Airtel Uganda customer support to find out the convenience fee for a particular withdrawal method.

Currency Conversion Fee

When withdrawing money from an Airtel Money Uganda account in a different currency, a currency conversion fee may apply. This fee is charged to cover the cost of converting the withdrawn amount from Ugandan shillings to the desired currency.

The currency conversion fee is an important component of Airtel Money Uganda withdrawal charges because it affects the total amount of money that the customer receives. For example, if a customer withdraws $100 from their Airtel Money Uganda account, they will receive the equivalent amount in Ugandan shillings minus the currency conversion fee.

The currency conversion fee varies depending on the amount of money being withdrawn and the currency being converted to. Customers can check the Airtel Money website or contact Airtel Uganda customer support to find out the currency conversion fee for a particular withdrawal.

It is important to be aware of the currency conversion fee before making a withdrawal in a different currency. This will help customers to avoid any surprises when they see the amount of money that has been deducted from their account.

FAQs on Airtel Money Uganda Withdrawal Charges

This section provides answers to frequently asked questions about Airtel Money Uganda withdrawal charges. These charges vary depending on the withdrawal method used and the amount being withdrawn.

Question 1: What are the different withdrawal methods available?

Answer: You can withdraw money from your Airtel Money Uganda account using the following methods:

- Airtel Money agents

- ATMs

- Bank accounts

Question 2: How much are the withdrawal charges for each method?

Answer: The withdrawal charges for each method are as follows:

- Airtel Money agents: UGX 500 for withdrawals up to UGX 50,000, UGX 1,000 for withdrawals above UGX 50,000

- ATMs: UGX 2,000 per transaction

- Bank accounts: UGX 1,000 per transaction

Question 3: Are there any additional charges I should be aware of?

Answer: Yes, there may be additional charges depending on the withdrawal method used. For example, some agents may charge a convenience fee for withdrawals. Additionally, if you are withdrawing money in a different currency, a currency conversion fee may apply.

Question 4: What is the minimum balance I need to maintain to avoid withdrawal charges?

Answer: There is no minimum balance required to withdraw money from your Airtel Money Uganda account.

Question 5: Are there any limits on the amount of money I can withdraw?

Answer: Yes, there are daily and monthly withdrawal limits. The daily withdrawal limit is UGX 1,000,000 and the monthly withdrawal limit is UGX 5,000,000.

Question 6: How can I check my withdrawal charges?

Answer: You can check your withdrawal charges by logging into your Airtel Money account or by contacting Airtel Uganda customer support.

We recommend that you familiarize yourself with the withdrawal charges before making a withdrawal. This will help you to avoid any surprises and ensure that you are getting the best possible value for your money.

For more information on Airtel Money Uganda withdrawal charges, please visit the Airtel Uganda website or contact customer support.

Tips to Save on Airtel Money Uganda Withdrawal Charges

Airtel Money Uganda withdrawal charges can add up, especially if you withdraw money frequently. However, there are several tips you can follow to save money on these charges.

Tip 1: Use Airtel Money agents for withdrawals.

Airtel Money agents typically charge lower withdrawal fees than ATMs or banks. For withdrawals up to UGX 50,000, the withdrawal fee at an Airtel Money agent is only UGX 500. For withdrawals above UGX 50,000, the withdrawal fee is UGX 1,000.

Tip 2: Withdraw larger amounts less frequently.

If you need to withdraw a large amount of money, it is better to withdraw it all at once rather than making multiple smaller withdrawals. This will help you avoid paying multiple withdrawal fees.

Tip 3: Take advantage of promotions and discounts.

Airtel Uganda sometimes offers promotions and discounts on withdrawal charges. For example, they may offer a reduced withdrawal fee for withdrawals made during certain hours of the day or for withdrawals made using a specific method.

Tip 4: Use mobile money transfer services instead of withdrawing cash.

If you need to send money to someone, you can use mobile money transfer services instead of withdrawing cash and then sending it. Mobile money transfer services typically have lower fees than withdrawal charges.

Tip 5: Keep your Airtel Money account balance above the minimum balance.

If you maintain a minimum balance in your Airtel Money account, you may be eligible for lower withdrawal charges or even free withdrawals.

By following these tips, you can save money on Airtel Money Uganda withdrawal charges. These savings can add up over time, especially if you withdraw money frequently.

We recommend that you compare the withdrawal charges of different methods and choose the one that is most cost-effective for your needs. You should also be aware of any promotions or discounts that may be available.

Conclusion on Airtel Money Uganda Withdrawal Charges

Airtel Money Uganda withdrawal charges are an important consideration for customers who use this mobile money service. These charges vary depending on the withdrawal method used and the amount being withdrawn. Customers should be aware of these charges before making a withdrawal to avoid any surprises.

Several tips can be followed to save money on Airtel Money Uganda withdrawal charges. These tips include using Airtel Money agents for withdrawals, withdrawing larger amounts less frequently, taking advantage of promotions and discounts, using mobile money transfer services instead of withdrawing cash, and keeping your Airtel Money account balance above the minimum balance. By following these tips, customers can save money on withdrawal charges and get the most out of their Airtel Money account.

Airtel Money Uganda withdrawal charges are subject to change. Customers should check the Airtel Uganda website or contact customer support to get the most up-to-date information on these charges.

Related Resources:

- Unveiling The Multifaceted Talents Of Jermaine Jackson Jr A Journey Of Music Acting And Legacy

- Unveiling The Legacy Of Samira Frasch Discoveries And Insights From Her Wikipedia

- Unveiling The Truth Exploring The Rumors Of Jimmy Kimmels Departure

- Unveiling The Secrets Mathew Knowles Wifes Age And Its Impact

- Milo And Otis Cruelty Disturbing Truths Revealed

Detail Author:

- Name : Anderson Sipes

- Username : reyes.moen

- Email : cary.bogan@mcclure.com

- Birthdate : 1983-04-22

- Address : 8254 Greenholt Plain Apt. 567 South Nattown, CT 28012

- Phone : 865-767-2464

- Company : Lindgren-Macejkovic

- Job : Forging Machine Setter

- Bio : Sapiente veritatis sunt vitae recusandae asperiores corrupti tempore. Deserunt blanditiis sint ea eos dolorem. Voluptatem nesciunt quasi quos autem ea aliquid sint nemo.

Socials

instagram:

- url : https://instagram.com/daughertyv

- username : daughertyv

- bio : Quos molestias non vitae et voluptate assumenda. Maiores optio natus temporibus quis.

- followers : 327

- following : 671

tiktok:

- url : https://tiktok.com/@vicky_daugherty

- username : vicky_daugherty

- bio : Nobis qui pariatur reiciendis pariatur dolores aut.

- followers : 2720

- following : 2388

facebook:

- url : https://facebook.com/vicky5829

- username : vicky5829

- bio : Sunt velit omnis aliquam enim maxime dicta in.

- followers : 3869

- following : 2618

twitter:

- url : https://twitter.com/vicky.daugherty

- username : vicky.daugherty

- bio : Velit ipsa eos quae ullam earum sapiente. Reprehenderit quia est accusamus et totam ut sit. Repudiandae non voluptatibus iste occaecati facilis animi.

- followers : 5000

- following : 1892

linkedin:

- url : https://linkedin.com/in/vickydaugherty

- username : vickydaugherty

- bio : Dicta est ipsam nam vel eos unde.

- followers : 6924

- following : 1869